Introduction

Analysis from Mikkel Nordberg, Veson Nautical's Senior Shipping Economist, indicates that the advantages stemming from the expansion of renewable energy capacity may outweigh the negative effects of diminished coal demand.

When considering a medium-term timeframe spanning from 2023 to 2026, Nordberg's estimations project that decarbonization efforts could result in a net increase of 26 million tons and 237 billion ton-miles. Decarbonization should not be considered unfavorable by dry bulk owners, as it will likely be a key demand driver the next couple of years.

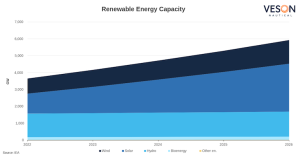

Renewables set to overtake coal by 2025

Thermal coal stands for about 36% of the world’s total energy generation and is the worst emitter, so replacing coal with renewable energy sources is a big step in the right direction.

Using data from IEA, Veson estimates that the global coal demand for electricity generation was roughly 5,770 Mt in 2023. Meanwhile, data from Oceanbolt, a Veson Nautical solution, shows that the total seaborne trade of thermal coal was 1,114 Mt last year, indicating that about 19% of coal used for energy production is transported by sea.

Using data from Energy Information Administration (EIA), Veson estimates that producing 1 TWh of energy requires around 520,000 tons of thermal coal. This means that the reduction in thermal coal demand will be 273 Mt. Assuming the seaborne thermal coal trade retains its 19% share of the total thermal coal demand, it suggests a reduction of 52.7 million tons in seaborne thermal coal trade by 2026.

The green transition needs dry bulk commodities The IEA is expecting electricity production from renewable energy sources to increase 3,200 TWh by 2026, which is an increase of 35.7%. This would require significant production of solar panels and windmills, that are largely made of steel and other metals transported on dry bulk carriers. Assessments from ArcelorMittal and Windeurope.org indicate that crafting 1 MW of production capacity involves approximately 40 tons of steel in solar panels, 120 tons in onshore windmills, and 150 tons in offshore windmills.

|

Applying these metrics, Veson's calculations indicate that the renewable energy expansion will demand approximately 101 Mt of steel by 2026. Assuming a ratio of 1.6 tons of iron ore to produce 1 ton of steel and maintaining the current blast furnace share of steel production at 71.5%, this translates to a projected increase in iron ore demand of 115.22 Mt. Information from Oceanbolt shows that the total seaborne trade of iron ore amounted to 1,639.8 Mt during the same period. Consequently, we estimate that approximately 68% of the iron ore supply is transported by sea. Applying this ratio, our analysis concludes that the expansion in renewable energy will lead to a 78.8 Mt increase in the seaborne trade of iron ore by 2026. Growing iron ore demand exceeding the demise of coal demand Based on the IEA projections, our calculations show that decarbonisation will lead to a decrease of ~53 Mt in the seaborne trade of thermal coal, and an increase of ~79 Mt in the seaborne trade of iron ore.

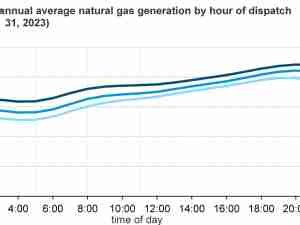

The maritime industry needs to consider the effect on ton-miles. Data from Oceanbolt shows that the average distance sailed during 2023 in the coal trade was 3,838 nautical miles, while it was 5,573 NM for iron ore. By multiplying the volume increases with the respective distances we conclude that there will be a 202 Bn decrease in ton-miles from thermal coal and a 439 Bn increase in ton-miles from iron ore. As a result, the decarbonization efforts will lead to a net increase of 237 Bn ton-miles. This is a 1% increase in total ton-miles from 2023 to 2026. |