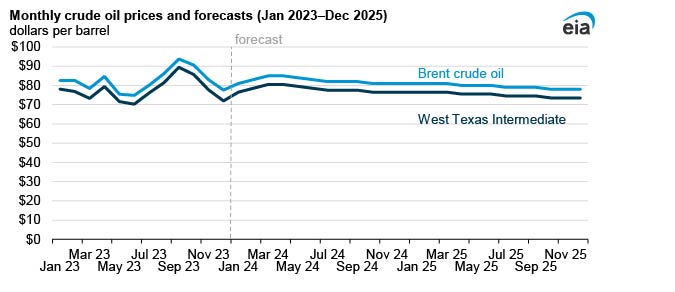

We forecast average annual crude oil prices in 2024 and 2025 will remain near their 2023 average because we expect that global supply and demand for petroleum liquids will be relatively balanced over the next two years. We expect the Brent crude oil price will average $82 per barrel (b) in 2024 and $79/b in 2025, compared with its 2023 average of $82/b. We expect that the price of West Texas Intermediate (WTI) will be slightly lower but generally follow the same path.

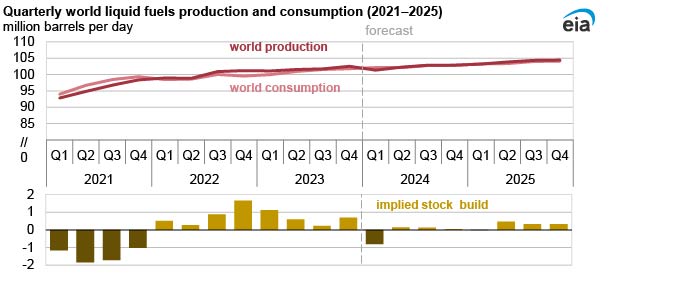

In the first quarter of 2024 (1Q24), we expect crude oil prices to rise somewhat, driven by OPEC+ production cuts leading to global stock draws of 810,000 barrels per day (b/d). As a result of the stock draws, we forecast the price of Brent will increase from $78/b in December 2023 to $85/b in March 2024. We expect that crude oil prices will gradually decrease after April 2024 with minor stock builds because global production increases more than consumption. We forecast stocks will increase by 110,000 b/d from 2Q24 through 4Q24 and by 280,000 b/d in 2025.

We attribute the relatively small crude oil price changes in our forecast to continued reduced OPEC+ production. We forecast OPEC+ crude oil production will drop from 37.1 million b/d in 2023 to 36.4 million b/d in 2024. In 2025, we expect OPEC+ crude oil production to increase, averaging 37.2 million b/d. These values do not include Angola, which left OPEC in January 2024.

The latest OPEC+ agreement, announced on November 30, included 2.2 million b/d of new voluntary cuts to its crude oil production target through March 2024. These cuts are in addition to existing voluntary cuts and lower production targets determined at its June 2023 meeting. We expect OPEC+ will produce less than its currently stated targets in 2024.

Non-OPEC+ countries, those countries not in or affiliated with OPEC agreements, produced an estimated 52.0 million b/d of petroleum liquids in 2023. We expect non-OPEC+ production to average 53.0 million b/d in 2024 and 53.9 million b/d in 2025. We expect that non-OPEC+ production growth will be driven by U.S. production increasing by 0.4 million b/d in both 2024 and 2025.

The growth of global petroleum consumption over the past two years was driven by economic growth and a return to pre-pandemic travel patterns, especially for international flights. We forecast global petroleum consumption to increase by 1.4 million b/d in 2024 and 1.2 million b/d in 2025, both of which are slightly less than the 10-year pre-pandemic average (2010–19).