Europe prays for a mild winter and friends in far flung places – from the US freeport facility to private Chinese companies that may be able to increase LNG exports to Europe during the heating season. Europe itself takes steps to introduce a price gap, but details remain vague, causing markets to continue to take a wait-and-see attitude.

After a volatile few months, European natural gas prices have been falling through September and October and are currently at their lowest level since June 2022, reaching $40 per million British thermal units (MMBtu) on the Netherlands-based Title Transfer Facility (TTF) yesterday (17 October).

Underground storage levels in Europe are continuing to build alongside policy efforts within the European Union to stabilize end-user prices.

The European Commission (EC) is considering intervening in the market to increase stability and liquidity and ease the upwards pressure on the European gas market.

Until then, with the gas withdrawal season approaching fast, market participants will be hoping to avoid any major supply outages and abnormally cold weather which would hit certain European nations, such as Germany, at the worst possible time. Asia and the US are presently sitting comfortably when it comes to supply and storage levels, though this could change as winter approaches.

Europe

Alongside LNG imports, Europe’s major gas supplier Norway is managing to offset the latest drop in Russian pipeline gas to keep supply at healthy levels.

In recent weeks, Norwegian gas flows have returned to 330 million cubic meters per day (MMcmd) following the end of September maintenance.

On 17 October, exit nominations from the Norwegian Continental Shelf (NCS) totaled 336 MMcmd, their highest level since the end of July.

LNG imports have also edged up on the back of strong spot purchases in August and September. Last week (week 41), LNG imports into Europe totaled 2.83 million tonnes (Mt), the highest level since the beginning of May.

Major LNG exporters to Europe include the US, Qatar and Russia which exported 0.96 Mt, 0.47 Mt and 0.45 Mt respectively in week 41.

On the supply side, Nigeria LNG has declared force majeure due to flooding in the Niger delta region.

It is still unclear how long it will last with around 3.8% of global monthly supply potentially impacted, representing an upward risk to prices.

Meanwhile, European gas demand has continued its year-on-year decline following measures put in place by the EC and demand destruction.

For the coming week, milder temperatures are expected across Continental Europe, which is expected to further depress demand for gas.

Falling demand is enabling Europe to build storage levels ahead of the winter withdrawal season.

European storage facilities are now 92% full, well ahead of the EU’s 1 November target, compared to 77% at the same time last year.

UK storage is 100% full, Germany 95% full, with Austria and Hungary at 78%.

This indicates that Austria and Hungary are on track to meet the EU’s target to be 80% full by 1 November.

EC to Meet Later This Week to Discuss Price Cap Concept

The EC has not yet reached consensus on whether to cap the price of gas for end users, with some countries pushing back on the idea due to the significant negative impact it could have on the supply-demand balance.

Several countries, including Germany, remain fundamentally opposed to a gas price cap on fears it could exacerbate the energy crisis by failing to address the EU’s fundamental supply issues.

For major gas suppliers such as Norway, which is presently maximizing production to meet Europe’s needs, a price cap could encourage producers to switch back to injecting gas for enhanced oil recovery instead.

The EC will meet in Brussels on 20-21 October to discuss the price cap idea further.

Firstly, the EC is considering measures to expand the list of assets that companies can use as collateral, boosting their ability to hedge transactions.

Secondly, they are considering creating a joint platform for gas purchases, a joint procurement which is key to ensuring that the EU can leverage their market power and avoid competing for a limited pool of volumes.

Third, they are planning a new benchmark, with the intention of providing an alternative to the TTF that they feel may better reflect LNG prices.

These mechanisms will be discussed in a separate media note from the Rystad Energy Gas Market Analytics team.

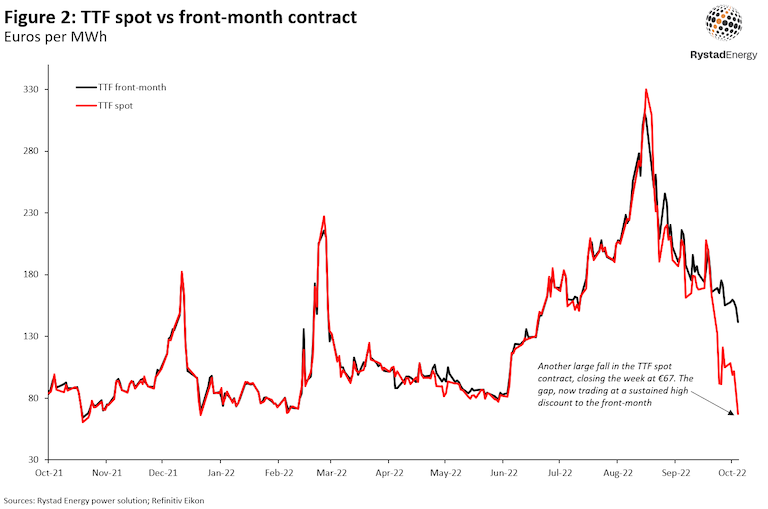

The trend of a large gap between the spot and front-month continues.

Factors contributing to the large delta between day-ahead and front-month price are: weak demand in the spot market caused by strong renewable generation, mild weather, strong Norwegian flows and LNG imports, in addition to storage levels reaching close to the maximum across Europe.

Low liquidity in the market is also causing higher volatility than usual.

Some of the premium for the front month is also that demand is expected to be much higher going forward, due to colder weather compared to now, pushing prices upwards in the futures market compared to the spot.

Russia

News from last week’s Russian Energy Week conference in Moscow included an indication that if Germany certified the Nord Stream 2 pipeline, Russia would immediately start flowing gas through it to Europe.

Turkish energy minister Fatih Donmez also confirmed Russian President Vladimir Putin’s proposal to establish a gas hub in Turkey which would be used to supply European buyers with Russian gas through the Turkish Stream pipeline, using volumes which would have flowed through Nord Stream 1 & 2.

On the LNG side, Yamal LNG is set to lift Russian LNG exports to 21 million tonnes in 2022.

Separately, Russia is considering investing $44 billion in Iran’s gas industry as its looks to re-direct gas volumes originally targeted for Europe.

Asia

Asian countries continue to compete with the European market, with high prices limiting overall buying activity and attracting fewer cargoes.

Traded gas prices on the Japan-Korea Marker (JKM) have fallen to $32/MMBtu but are still tracking Europe’s TTF price.

With storage inventories in Japan and South Korea at high levels, the market’s focus has now shifted to January 2023 LNG imports.

Demand for gas in Asia is still low compared to the European market, with Asia preferencing alternative fuels.

China and South Korea are both looking to coal-fired generation to meet heating demand over the northern winter.

For its part, falling LNG prices has tempted China back in the market, despite it having adequate inventory levels.

In order to secure enough supply for the coming winter, China has told its state-owned gas importers to stop reselling LNG to the rest of Asia and Europe.

However, there is no clear message from the government that companies cannot resell cargoes.

But each year they have been informed to make to energy security a top priority as a general practice.

Overall, Chinese companies, especially the stated owned companies, are very careful when handling re-export business.

These state-owned companies already have a commitment to the government on ensuring its energy supplies.

However, private companies in the past have been more aggressive and bolder, driven by arbitrage – and may do so again this winter.

US

Henry Hub gas prices remain under $7/MMBtu, reaching $6.23/MMBtu at the time of writing. US storage levels are now at 3,231 billion cubic feet (Bcf), an increase of 125 Bcf week-on-week.

A combination of factors has helped boost storage in recent weeks.

On the supply side, dry gas production continues to be at record levels, averaging just shy of 100 billion cubic feet per day (Bcfd) so far in October.

Domestic balances have also been boosted by recent outages at the 2.0 Bcfd Freeport LNG and the 700 MMcfd Cove Point LNG export facilities, meaning that 2.7 Bcfd of natural gas which is usually exported as LNG has instead been directed into the local market since June and late September respectively.

Cove Point is scheduled to return online today (18 October) with Freeport LNG set to gradually resume operations next month. Two vessels are presently en route to Freeport, Prism Brilliance and Prism Diversity, with combined export capacity of 158.74 million tonnes.

This suggests that Freeport could achieve 85% adjusted nameplate capacity by end-November.

However, the facility’s re-start could yet be delayed, which would require the vessels to either increase voyage time or idle offshore in the Gulf of Mexico.

Freeport’s restart timeline could have a significant impact on gas prices as the US heads into the winter months.

Once both Cove Point and Freeport have restarted and are exporting into the global market, weather forecasts will likely be trending colder, putting upward pressure on natural gas prices.

In this scenario, Henry Hub gas prices could hover closer to $7.00 per million British thermal units (MMBtu) this winter, supported by our expectation that LNG exports will remain robust and there will be increased demand for heating this winter on limited coal-switching options.

However, there is still much uncertainty over winter weather forecasts and hence demand.