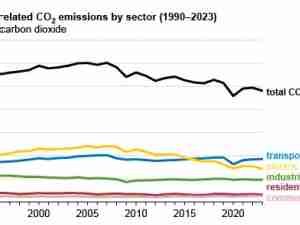

Natural gas demand among European industries has dropped by the most since the early days of the pandemic, with soaring prices prompting widespread output cuts and factory shutdowns.

Fourth-quarter industrial gas use in northern Europe fell by almost 5% from a year earlier, the biggest decline since the second quarter of 2020, according to Engie EnergyScan. Pressure on U.K. firms got so bad that demand there sank 54%, and a recent new wave of shutdowns suggests the trend will continue.

“As reports of factories shutting down or possibly not resuming operations after the end-of-year break are coming again, industrial demand destruction could resume in the first quarter,” said Julien Hoarau, head of the energy consulting firm. It may be similar to the slump in gas use seen last September and October, he said.

The pullback in gas demand has followed unprecedented market volatility, with wholesale prices rocketing last quarter as supplies fell short and winter set in. In the U.K., British Steel has stopped taking new orders for a “range of products,” while metals giants including Alcoa Corp. and Norsk Hydro ASA are scaling back output across Europe and chemicals firms are shuttering plants.

“The cost burden for companies has reached record-highs,” said Jorg Rothermel, head of energy at the VCI German chemical industry association. The price surge “will sooner or later hit all companies.”

Industrial consumption in northern Europe weakened further in the last days of 2021, with gas use falling more than 7% in the final week of the year, according to Engie EnergyScan.

The firm compiles data from gas-transmission system operators. Where figures on industrial consumption aren’t available, it takes total demand data and cuts out residential, commercial and utility gas use.

Benchmark European gas futures rose to a record in December, before dropping back as supply woes eased. The rally has resumed this year as Russia keeps a tight grip on shipments, maintaining the pressure on buyers across the region.

“We are very concerned about the rising energy costs,” Germany’s steel trade association said. They “threaten to put a massive strain on the international competitiveness of electricity-intensive processes.”

Among major metals producers, Alcoa is halting primary aluminum production at its Spanish plant for two years, Norway’s Norsk Hydro is cutting output in Slovakia and Trafigura Group’s Nyrstar unit is mothballing a zinc smelter in France. Among other industries, Germany’s top ammonia producer SKW Piesteritz Holding GmbH decided to shut down one of its plants in December.

_-_28de80_-_939128c573a41e7660e286f3686f2a6e25686350_yes.jpg)