Short-term outlook: cessation of supplies through Nord Stream 1 reignites market fears

With flows via Nordstream 1 stopped, Europe is now facing its worst-case gas scenario

The focus on increasing storage earlier this summer temporarily paid off with prices receding but the latest cut from Russia caused prices to rebound.

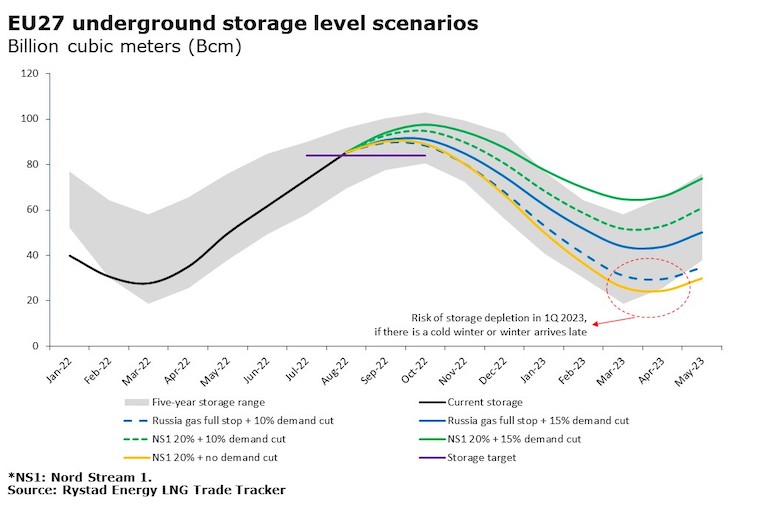

On the current trajectory, Europe’s gas pain will hit hard in Q1 2023 as storage levels decline to zero – how hard will depend on LNG imports and the weather forecast.

Europe gas storage woes will hit in Q1 2023

Rystad Energy LNG Trade Tracker shows that Germany’s gas storage facilities are now 85% full as of 3 September, well ahead of the October target.

In the EU, storage facilities are now 81% full, ahead of the November target.

If EU storage facilities can be filled up to 100% of capacity before the northern winter arrives, the region will have between 2-2.5 months’ worth of gas, assuming monthly demand of 140-150 billion cubic meters (Bcm).

This means that Europe would have sufficient gas supply for the early winter months of November and December.

However, there is a supply risk for the first quarter of 2023.

This risk will increase if Nord Stream 1 stays shut or runs at very low rates and if there is a cold winter or spring arrives late, in such a scenario, EU gas storage facilities could be significantly depleted by March or April 2023.

At the same time, the EU could face rising competition for LNG from Asian buyers if winter in that region is also cold.

This could exacerbate problems in securing supply and push prices to even more extreme levels.

Equinor has indicated that unless the EU intervenes to support the gas market then a collapse is on the cards.

Figures as high as a $1.5 trillion package have been suggested by industry

TTF prices track higher on Monday as market looks ahead to upcoming winter

European gas prices rebounded strongly on 5 September as Russia’s Gazprom announced that supplies through the Nord Stream 1 pipeline would not resume following maintenance work.

The pipeline’s closure has reignited market fears that Europe is heading for gas shortages as winter approaches, despite healthy storage levels providing some relief last week.

In the US, gas prices have remained largely flat with weather and storage the main ongoing focus.

With ample inventories, Asia’s buying and spot prices have continued to lag Europe, with high prices also limiting overall buying.

Europe: TTF resurged due to Nord Stream 1’s closure

Early last week, healthy storage levels in Europe looked to be offsetting concerns about Russian supplies and resulted in prices retreating on the Netherlands-based Title Transfer Facility (TTF).

However, the possibility of a further disruption to Russian gas supplies became apparent on 2 September when Gazprom announced that Nord Stream 1, the major pipeline route to Europe, would not return on schedule due to technical issues found during its three-day-long maintenance period.

TTF front-month prices reacted strongly on Monday, at one point surging above €284 per megawatt-hour (MWh) or $83 per million British thermal units (MMBtu) before retreating to €246/MWh or $72/MMBtu at close.

According to Gazprom, during scheduled maintenance on NS1 from 31 August to 3 September, a sealing compound in the gas compressor was found to be leaking oil.

As a result, Gazprom has fully shutdown pipeline flows until the defect has been fixed.

No timeline has been given for the resumption of flows which is likely linked to the wider geopolitical situation as much as technical issues.

The major conduit for Russia gas flows into Germany and thence Europe, Nord Stream 1 usually runs at about 160 million cubic meters per day (MMcmd).

Since mid-June, however, flows have been tracking close to 60 MMcmd and fell to about 30 MMcmd in late-July before halting completely last week.

Inevitably, Nord Stream 1’s closure is pushing up gas prices.

For downstream users, such as industrial plants and utilities, this means a worsening but not unexpected scenario.

Panic sentiment could put even more upward pressure on prices, as reflected by TTF futures.

But for spot prices, the risk premium may have been priced in, resulting in the price differential between spot prices and TTF futures.

The Northwest Europe delivered ex-ship (DES) price for October deliveries is presently at over a $20/MMBtu discount to the TTF.

On the other hand, we could see further demand destruction if gas prices exceed affordable levels for buyers.

Rising energy prices have resulted in widespread inflation around the world and, according to EU officials, have been responsible for nearly 40% of Europe’s recent inflation.

As a result, we are seeing some European countries intervening in the market, setting price caps and seeking to decouple gas and power prices.

In response to the deepening crisis, the European Commission is set to discuss intervention plans on 9 September.

Some countries, such as Germany and France, have signaled that they may consider rationing gas if supply tightens over winter.

If this happens, the residential sector would likely be prioritized for supplies, while the industrial sector could be hardest hit.

Industrial plants in Europe have already seen notable impacts from soaring gas prices, with many cutting run rates.

For countries such as Germany and France, where gross domestic product (GDP) largely comes from industrial output, their economies could experience an unprecedented impact.

Russian gas flows via other pipelines, including via Ukraine and via the TurkStream pipeline to Turkey, have remained largely stable at around 35 MMcmd and 37-40 MMcmd respectively.

However, there is a potential risk that these flows could drop given the tense geopolitical situation.

In the meantime, Norwegian gas flows are stable at around 290 MMcmd, despite dropping slightly compared to a month earlier due to further maintenance.

To boost LNG imports, Europe has proposed a wave of LNG regasification projects this year, a few of which are expected online soon.

The 5.9 million tonne per annum (Mtpa) floating storage and regasification unit (FSRU) at Eemshaven in the Netherlands is expected to start up in the third quarter of 2022.

Germany’s first LNG import terminal, the 5.5 Mtpa Wilhelmshaven FSRU officially started construction in July and is expected to start operating in late-2022 or early-2023.

Germany’s second terminal, the 5.9 Mtpa Brunsbuettel FSRU, will likely start constructions in September.

Both facilities will provide some relief for Germany as it seeks to urgently diversify gas supply away from Russia.

German company Uniper has signed a sales and purchasing agreement (SPA) with Australian gas producer and exporter Woodside to import LNG into Germany and Europe between 2023 and 2039. Under the agreement, up to 12 LNG cargoes will be supplied annually.

Until now, European companies have rarely signed term contracts as piped gas has provided a solid base of supply.

Now, however, supply concerns have prompted companies such as Eni, Engie and EnBW to sign LNG contracts this year.

US: prices largely flat from last week

In the US, Henry Hub prices have been relatively stable compared with the TTF, despite a 3% week-on-week drop to $8.8/MMBtu at the time of writing.

Meanwhile, there are still upsides from low storage levels and above-normal temperatures in the US.

US storage facilities now hold 2.64 trillion cubic feet (Tcf) of natural gas for the week ending 26 August, up 61 billion cubic feet (Bcf) week-on-week, compared with an expected increase of 56 Bcf.

However, the storage level is 228 Bcf lower than a year earlier and 338 Bcf lower than the five-year average.

With another two months of the injection season still to run, prices have already reached their highest level since 2008.

If storage levels stay lower than historical levels this winter, Henry Hub prices may trend even higher.

Weather in most US regions is still forecast to stay above normal through to mid-September.

This has lifted gas consumption for power generation by 6% week-on-week to 40.5 Bcf for the week of 25-31 August.

Total gas consumption rose 4% in the same period to reach 70.9 Bcf.

Hurricane Danielle formed in the middle of the north Atlantic region late last week, but liquefaction plants in the US are unlikely to be impacted, as the hurricane is expected to move northeast and away from the US.

Asia: continue to track behind Europe on ample inventories and high prices

In Asia, spot gas prices have fallen over $10/MMBtu for October delivery compared to a week earlier to reach $55.2/MMBtu.

Ample inventories and high prices have limited buying appetite in the region, although some buying from Japan and South Korea for early winter delivery has been seen.

Heatwaves and drought in China’s south-west have been abating, with cooler weather and rain finally arriving in many places.

A power crunch in the region has also largely alleviated but may prompt the gas-rich region to deploy gas-fired power to balance out its power mix.

As mentioned in our previous outlook, lower-priced pipeline gas has made this more attractive for China than LNG and support firm growth this year.

Also, to avoid high import costs, China has been dominating global LNG contracting activity since last year and has signed 43 Mtpa of term contracts, making up 35% of global SPAs signed over the period. With ample inventories and low-cost import channels, China has been staying away from spot market. The share of spot cargoes in China’s LNG imports has fallen below 20% this year compared to over 40% last year.

However, with winter approaching, China may increase spot purchases as restocking is prioritized by the government to ensure supply security.

In Japan, the government may directly buy LNG cargoes on behalf of private companies to ensure winter supplies. State-owned company JOGMEC is reported to be buying extra cargoes for winter, as private buyers may not afford to buy them.

On the supply side, the 3.6 Mtpa Prelude floating LNG (FLNG) facility offshore Western Australia is expected to resume loading LNG from 8 September.

A prolonged labor strike on the vessel ended last week after more than 70 days.

The outage took 650,000 tonnes of LNG out of the global market.

_-_28de80_-_939128c573a41e7660e286f3686f2a6e25686350_yes.jpg)