Prices at the Dutch Title Transfer Facility (TTF) reversed declining trends this week, with prices increasing upwards from $7.80 per million British thermal units (MMBtu) on 20 February, to $8.02 per MMBtu as of 1 March 2024. However, bearish fundamentals are still on the horizon, with Europe’s storage facilities largely full as the end of winter nears.

The lack of demand from a warmer-than-normal winter thus far has dampened demand for heating although, with prices starting to fall below $8 per MMBtu, there may be increased activity in the market as prices become more palatable for optimization, especially if it makes gas-fired plants more economical than coal-fired generation.

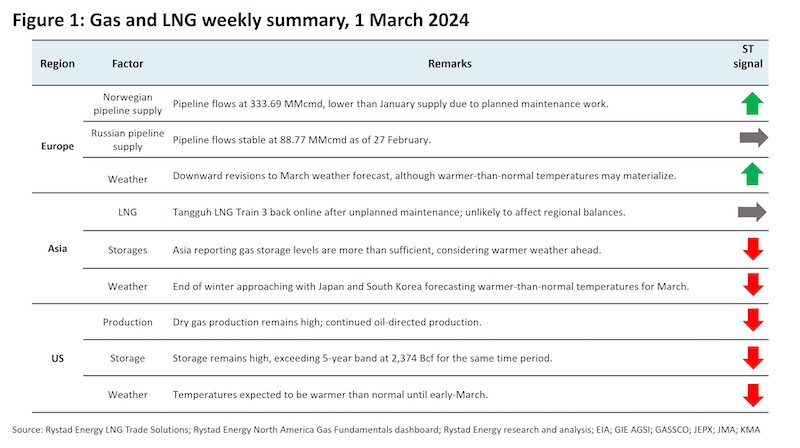

There are already indications that, with falling gas prices, a pick-up in gas demand could be on the cards. Asia and the US are seeing similarly bearish fundamentals.

Asia spot LNG prices dipped just slightly, from $8.57 per MMBtu the week before on 20 February, to $8.37 per MMBtu last Friday 1 March.

Meanwhile, Henry Hub prices have increased to $1.84 per MMBtu last Friday 1 March , from $1.56 per MMBtu the week before on 20 February.

This reverses the declining trend in Henry Hub prices, which have generally been falling all winter.

Higher-than-expected storage withdrawals in recent weeks may have contributed to the temporarily bullish sentiment.

Europe

Prices have increased at the end of last week as weather forecasts anticipate a slightly colder-than-expected second half of March, compared to forecasts a week ago.

Up to mid-March, temperatures are expected to be warmer-than-normal range. Norwegian pipeline flows are currently at 333.69 million cubic meters per day (MMcmd) as of 28 February.

This is slightly lower than the 350 MMcmd seen in January and can be attributed to a range of planned maintenance work.

The flows are still stable and at high-enough levels, despite causing some price increases on the TTF. Russian pipeline flows to Europe have maintained at 88.77 MMcmd as of 27 February, in line with previous weeks.

Europe’s underground gas storage levels remain on the high side at 72.55 billion cubic meters (Bcm) or 63.1% full on 27 February, which is higher than the 69.67 Bcm or 61.4% a year ago.

Storage levels are also in the upper boundary of the five-year band, with the five-year maximum at 76.27 Bcm.

Coal API2 front-month prices increased to US$103.63 per ton as of 28 February following US sanctions on Russian coal producers SUEK and Mechel, which could result in lower coal supply into Europe, pushing prices up.

On the other hand, EU Allowances (EUA) futures for March 2024 were at 53.46 euros per tonne of carbon dioxide emitted.

It appears that, with rising coal prices and declining gas prices, coal to gas switching is likely to occur even after accounting for EUAs.

This may have been behind the slight increase in TTF prices last week as there was revised demand for gas-fired generation.

Asia

There is still some optimization activity underway in the Asian market with spot LNG prices still slightly above the $8 per MMBtu mark, maintaining at low levels not seen since 2021.

LNG players in the market will keep a keen eye on how LNG prices may evolve to optimize spot activity as winter draws to a close.

The transition to warmer temperatures typically brings about lower gas and LNG prices due to less pronounced demand for heating.

Vietnam’s PetroVietnam Gas appears to have procured a spot cargo for an April delivery at its Thi Vai LNG terminal, taking advantage of the lower prices.

In South Korea, the Meteorological Administration is forecasting around a 40% probability of above-normal temperatures until the third week of March.

Thereafter, there is a 50% probability of warmer-than-normal temperatures until the first week of April.

In Japan, the Meteorological Agency is forecasting around a 40% probability of above-normal temperatures until the end of March in nearly all prefectures. For now, the longer-term forecast extends the probability of above-normal temperatures into May.

In China, a cold snap is expected in the northern region in the coming week, with temperatures expected to be 1-2 degrees below normal.

In the northeast, temperatures are expected to be 3-4 degrees below normal. It is a mixed bag in terms of weather forecasts, with other parts of China set to experience either normal or above-normal temperatures.

Most of Asia began the winter with more-than-sufficient LNG inventories, and this has continued to hold true until now, with adequate inventories still being reported by Asian players as the end of winter approaches.

Japanese power utilities reported LNG inventories of 2.16 million tonnes (Mt) on 25 February, up from 2.09 Mt per the previous report.

This is 1% higher than typical end-February numbers for the past five years, but 13% lower than last year.

Given the high probability of above-normal temperatures for South Korea and Japan in the coming month, and the fact that northern China’s cold snap is likely to end in early March, the draw on LNG inventories and imports is anticipated to be low.

The El Nino phenomenon is expected to tail off in April, according to China’s National Climate Center.

This forecast mirrors the one from Australia’s Bureau of Meteorology in a February update, which forecast an April-May end to the phenomenon.

El Nino is typically associated with warmer weather, such as milder winters across the northern hemisphere.

Like Europe, with coal prices increasing, and a lower cost of gas and LNG, coal-to-gas switching is likely to become more prevalent in the coming months if these trends continue.

If this happens, there may be increased demand to optimize power generation with cheaper spot LNG cargoes.

US

An unexpected increase in Henry Hub prices is countering bearish fundamentals seen in recent weeks.

Warm weather is expected to dominate discussions on weak US gas demand, with the number of heating degree days (HDDs) expected to be below normal through the first week of March.

A lower number of HDDs implies there will be less demand for heating, which has been the trend observed throughout most of the winter this season.

US underground gas storage levels were at 2,374 billion cubic feet (Bcf) as of 23 February 2024 and have already exceed the five-year maximum of 2,169 Bcf for the same time period.

Backing up sentiment that storage levels are higher than usual, current storage levels are 27% up on the five-year average, and 12% higher than the same period last year.

Withdrawals from storage totaled 96 Bcf from 16 to 23 February, as temperatures turned out to be colder than previously forecast, causing an increase in net withdrawals.

Since then, the weather returned to normal temperatures for just a few days and is now set to be warmer-than-normal in the coming days.

Higher withdrawals from storage are likely to drive some bullish sentiment, leading to a positive gain in Henry Hub prices.

However, any Henry Hub price changes in the coming months will be contingent on the effects of weather on gas consumption and corresponding withdrawals from storage.

Freeport LNG Train 3 extended its maintenance to mid-March following an electrical problem arising during Winter Storm Heather in late January.

The extension of maintenance from one train is not expected to affect global LNG balances and prices adversely due to the currently well-supplied market environment.