Key insights:

- The continued surge in ocean volumes kept freight rates elevated but level this week, as the global index hit a 173% increase compared to this time last year.

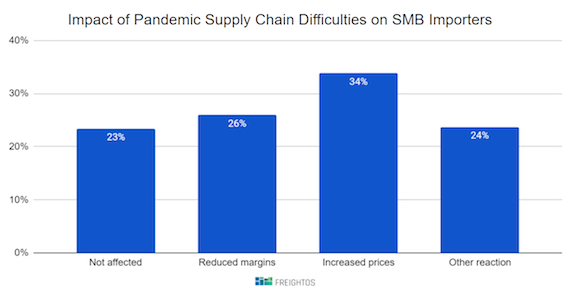

- A recent survey of SMBs importers using the Freightos.com marketplace found that 77% had been impacted by supply chain difficulties, and 34% had increased their prices as a result – an early indication that rising freight costs may end up being passed on to consumers.

China-US rates:

- China-US West Coast prices (FBX01 Daily) ticked up 2% to $4,312/FEU. This rate is 183% higher than the same time last year.

- China-US East Coast prices (FBX03 Daily) dipped 3% to $5,766/FEU, and are 103% higher than rates for this week last year.

Analysis

The unrelenting surge of ocean volumes continues to cause port congestion and delays that have plagued the industry since November. Though there are signs that the resulting empty container shortage may be starting to ease, it is unlikely to disappear until demand eases. A recent outbreak of COVID-19 infections among LA/Long Beach dock workers may even make the situation worse at the already-overwhelmed port.

Delays at clogged ports have led carriers to cancel sailings in order to catch up with disrupted schedules, showing how long delays are effectively a removal of future capacity – another factor keeping rates extremely high.

Overall, rates on the major ex-Asia lanes stayed level but extremely elevated this week, with the global FBX index 173% higher than this week last year.

High freight costs are already pricing some small, low margin businesses out of the market, and there is growing concern that these costs could contribute to inflation.

A recent survey of small importers on the Freightos.com marketplace found that 77% of these businesses experienced supply chain difficulties due to the pandemic over the last six months. In order to contend with the ramifications of higher costs and thinner inventories, 34% reported that they increased product prices, while another 26% said they had to reduce their margins.

Air cargo rates out of Asia have declined to start the year by 5% or more over the last two weeks on most US and European lanes, according to Freightos.com marketplace data, but are still at least double their normal seasonal levels. Demand for air cargo out of Asia is expected to increase and keep rates up in the coming weeks, and WebCargo search data for eBookings show that demand out of Europe is climbing back toward its November peak season level after a lull to start the year. Concern over new outbreaks and quarantine requirements in China, however, could lead to new disruptions. |