Key insights:

China-US ocean rates stayed stable again, though container shortages for the transpacific are leading to surcharges as well as rising rates and shortages on Asia-EU lanes where prices climbed 6% so far this month and are up 47% over last year.

• China-US rates: China-US West Coast prices (FBX01 Daily) went unchanged at $3,846/FEU. This rate is (still) 153% higher than the same time last year.

• China-US East Coast prices (FBX03 Daily) were also stable, climbing 1% to $4,735/FEU, and are 81% higher than rates for this week last year.

Analysis

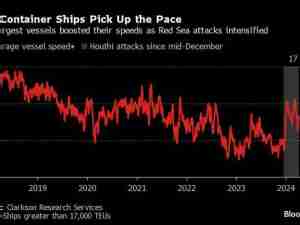

Though ocean rates from China to the US stayed level for another week, continued peak season volumes are overwhelming some US ports and causing a significant shortage of empty containers at Asian origins and beyond. There are even reports that despite demand, some ships aren’t sailing fully loaded simply for a lack of empty containers.

The sustained surge is not only keeping rates high, but also leading to peak seasons surcharges, equipment charges, and premiums to guarantee space.

Strong demand on Asia-North Europe lanes is putting pressure on rates that have climbed more than 6% to $2,232/FEU so far this month. Prices are now up to the multi-year high set in mid-September, and nearly 50% higher than this time last year.

But ocean carriers are also prioritizing empty containers for the more lucrative transpacific routes making equipment and, in effect, capacity scarce and contributing not only to severe backlogs and delays at some UK ports, but also to the rate increases on Asia-EU lanes as well.

Air rates stayed elevated this week, up as much as 8% on some China to US and European lanes so far this month according to Freightos.com marketplace data as capacity stays limited and peak season shipments are underway. There is some speculation that demand from Asia to destinations in Europe with new shutdown restrictions may dip as retailers postpone orders until December. Similarly, for eCommerce importers, ocean rates for importing directly to Amazon FBA warehouses remained stable while air cargo rates returned to their mid-October highs.