Peak season shipping is in full swing, as evident by China-US shipments operating on a 3-4 week backlog since mid-July.

Peak season is impacting freight prices too. Back in the last week of June, at $1,210/FEU, China-West Coast prices were just one dollar less than the previous year. But they’ve risen 73% since then and are now 34% up on last year’s prices.

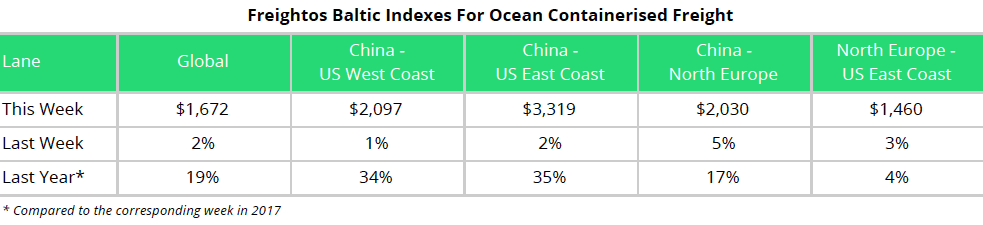

This week’s report

China-West Coast rates are 34% higher (China-East Coast 35% higher) than at the same time last year.

With recent GRIs sticking, it’s no surprise that, on top of the September 1 increase, some carriers have announced a GRI for a September 15 GRI as well – making it the 17th so far this year.

As well as improved carrier discipline, other factors are at play, like advance ordering to beat the new tariffs on China imports. This issue may be masking an underlying rise in demand, and in itself will have a limited impact on pricing.

Recent typhoons in East Asia have caused disruptions, especially rollings caused by ships skipping a scheduled docking. Hurricane Lane also briefly impacted cargo in and out of Hawaii this past Saturday.