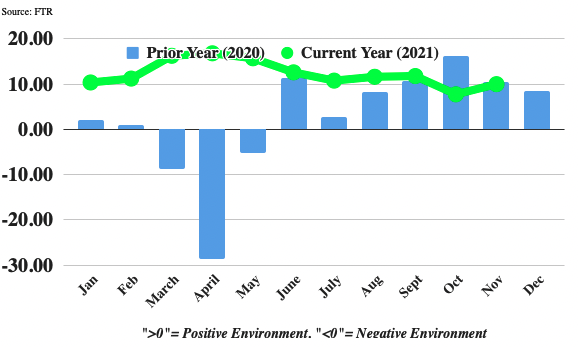

FTR’s Trucking Conditions Index (TCI) for November rebounded from October’s 7.75 to a 10.0 reading for the month primarily due to steadier diesel prices. Slightly firmer freight volume and rates also contributed to the gain.

Diesel prices could continue to introduce some volatility into the TCI as prices declined in December but have risen sharply more recently. Even so, FTR’s outlook is for the TCI to remain in the same range as November through 2022Q1 and then settle into high single digit positive readings for the remainder of 2022.

Details of the November TCI are found in the January 2022 issue of FTR’s Trucking Update, published December 23. The January edition also includes an analysis of a range of freight market forecast risks heading into 2022.

Beyond the TCI and additional commentary, the Trucking Update includes data and analysis on load volumes, the capacity environment, rates, and the economy.

Avery Vise, FTR’s vice president of trucking, commented, “Although we continue to forecast a quite gradual easing of trucking companies’ robust market conditions beginning in the second half of the year, we certainly are seeing no signs of that happening yet. Freight rates continue to strengthen at least marginally as the spot market shows unprecedented resilience. Solid consumer spending and industrial demand should maintain a high floor on trucking conditions even if we see some modest gains in capacity and productivity.”

The TCI tracks the changes representing five major conditions in the U.S. truck market. These conditions are: freight volumes, freight rates, fleet capacity, fuel price, and financing. The individual metrics are combined into a single index indicating the industry’s overall health. A positive score represents good, optimistic conditions. Conversely, a negative score represents bad, pessimistic conditions. Readings near zero are consistent with a neutral operating environment, and double-digit readings in either direction suggest significant operating changes are likely.