Japan’s exports continued to show the effects of supply chain snarls as gains from year-earlier levels masked signs of weakness that could drag on an economy struggling to eke out growth this quarter.

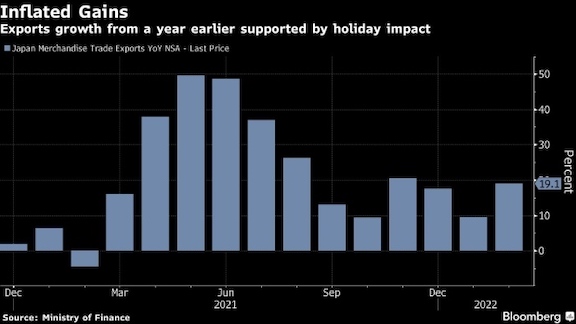

The value of Japan’s overseas shipments increased 19.1% from a year earlier, led by gains in car and steel exports, following a 9.6% rise in January, finance ministry data showed Wednesday. Analysts had forecast a 20.6% increase in February.

A seasonally adjusted 0.5% fall in exports from the previous month indicated that the yearly gains overstated the strength of shipments in February, with economists citing the different timing of Lunar New Year holidays as a factor explaining the discrepancy.

Imports continued to rise at a faster-than-expected pace, inflated by elevated energy prices. Inward shipments rose 34% from a year ago, compared with a 26.4% gain forecast by analysts.

The slight fall in exports on a monthly basis reflects the ongoing challenges confronting Japanese companies as they grapple with global supply chain snarls during the pandemic, with the war in Ukraine adding to uncertainties going ahead.

The economy is reliant on external demand this quarter to avoid shrinking again as omicron-related restrictions weigh on domestic consumption. The outlook for global demand is looking gloomier with sanctions on Russia expected to disrupt trade and exacerbate energy supply issues.

“With the Ukraine war it’s likely there’ll be further supply chain constraints going forward not just for autos but in a broad range of products,” said Takeshi Minami, chief economist at Norinchukin Research Institute. “It’s going to be difficult to look to exports to be a leading growth factor for Japan this quarter.”

Underscoring the lingering supply-side issues, Toyota Motor Corp. has cut its Japan production plan for the April-June quarter and halted a plant in China’s Changchun in the wake of a virus lockdown there.

Meantime, the rising value of imports, particularly the price of energy together with a weaker currency, is expected to add to the weakness in domestic consumption as household purchasing power is crimped.

Still, Japan’s trade deficit narrowed to 668.3 billion yen ($5.6 billion) in February after posting its biggest deficit in eight years in the previous month.

What Bloomberg Economics Says…

“The data suggest net exports will drag on GDP in the first quarter, adding to challenges from weak consumption due to virus-containment measures.”

—Yuki Masujima, economist

Prime Minister Fumio Kishida has increased fuel subsidies to try to keep a lid on gasoline prices and may take further action. He’s also taking a cautious approach to virus management—having extended quasi-emergency measures until late March—ahead of a summer national election.

Today’s trade report showed the value of shipments to Europe rose 8.8%. Exports to the U.S. grew 16% while those to China expanded 26%.

The yen’s recent weakness, which has persisted during the war in Ukraine, has also contributed to a rise in the import costs.

Bank of Japan Governor Haruhiko Kuroda has downplayed the impact of a lower currency and pledged to keep up monetary stimulus. That approach contrasts with some other central banks that have shifted toward policy tightening to combat inflation, with the added advantage that it boosts their currency and lowers imports costs.

The BOJ is set to wrap up its latest policy decision on Friday and no changes to monetary settings are expected.