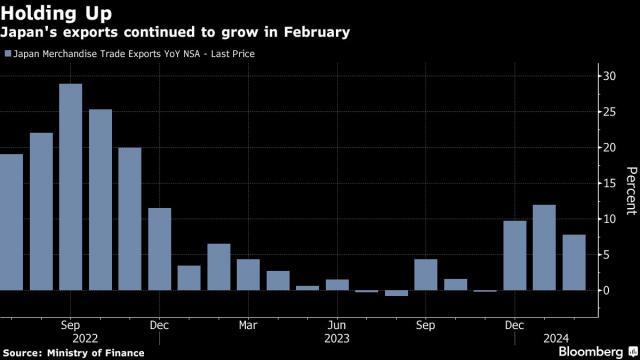

Japan’s exports grew for a third consecutive month on the back of robust shipments of vehicles, offering support for the economy as domestic demand remains patchy.

Exports rose 7.8% in February from a year earlier, the finance ministry reported Thursday. That compared with a 5.1% gain estimated by economists. Imports advanced by 0.5%, matching the consensus forecast. The trade deficit narrowed to ¥379.4 billion ($2.5 billion). Seasonally adjusted exports fell 1.5% compared with January.

Shipments of vehicles rose by 20%, while those for autoparts rose about 23%, underpinning the year-on-year result. Those gains came even as Japan’s auto output took a hit after Daihatsu Motor Co., a subsidiary of Toyota Motor Corp., had to suspend domestic production and deliveries of multiple models from December over a vehicle certification scandal. Some of that output was restored last month, while other factory lines only came back on line this month.

By region, shipments to the US increased 18%, while those to Europe advanced 15% and China saw a 2.5% increase, even as the lunar new year holidays reduced the number of February working days in 2024.

“Exports are strong, with those to the US rising by double digits,” said Takeshi Minami, economist at Norinchukin Research. “The data betray the assumptions that high-interest rate policies will slow down the global economy.”

Japanese exporters are monitoring demand prospects in their key overseas markets. The Federal Reserve signaled it will stick with its plan to cut rates three times this year as it attempts to secure a soft landing after years of fighting inflation. China’s strong factory output and investment growth at the start of the year raised hopes for Japanese exporters.

The ongoing growth in exports, even with the holidays in China and an auto production slowdown at home, is a bright spot for an economy in which domestic demand and industrial output have shown signs of weakness. Capital spending data were revised higher in the fourth quarter, enabling the economy to avoid a technical recession, but household spending has fallen 11 straight months as households pare outlays in the face of persistent inflation.

What Bloomberg Economics Says...

“Solid demand for Japanese cars is boosting auto exports to markets like the US and EU. A positive turn in the world’s semiconductor cycle is also bolstering shipments of chip-making equipment to Asian markets such as China.”

— Taro Kimura, economist

The economy is projected to record another small expansion in the current quarter, although a minority of economists surveyed by Bloomberg expects the economy will fall into contraction.

In conducting its first rate hike since 2007 on Tuesday, the Bank of Japan said the economy was recovering moderately with some weakness, adding that the pace of the recovery had slowed overseas. Governor Kazuo Ueda has cited pockets of consumption data as a source of weakness.

“Consumption will be the key for the economy from here,” Minami at Norinchukin Research said. “If spending picks up on the back of wage hikes, the BOJ can confirm a virtuous cycle is settling in and consider another rate hike.”

The yen holding around its lowest level in decades is expected to continue offering support to exporters. For the February report, the average exchange rate was 148.2 yen against the dollar, with the yen 13.7% weaker than a year ago, the ministry said.