The Biden administration is reevaluating the climate criteria it uses when approving new liquefied natural gas export facilities in a move that has the potential to stall pending projects as the 2024 election nears.

A panel of government officials convened by White House climate adviser Ali Zaidi met to develop a policy recommendation on the issue for President Joe Biden, according to two people familiar with the matter who weren’t authorized to speak publicly. The officials met Saturday, one of the people said. Biden, has been briefed on the issue but has yet to make a decision, a second person said.

The recent deliberations — a collision of domestic and geopolitical issues — are fraught for the White House. The administration’s approval of fossil fuel projects has been under tough scrutiny from environmentalists and drawn blowback from young voters critical to Biden’s reelection. The US has been planning to significantly grow exports of liquefied natural gas, or LNG — a move that would help loosen Russia’s energy leverage on Europe and shore up fuel supply across Asia.

The Department of Energy, which issues export permits, is checking whether it’s properly accounting for the climate impact of proposed plants, Politico earlier reported, citing an unidentified senior US administration official.

An Energy Department spokeswoman said the agency didn’t have any updates on its approval process. The White House didn’t immediately comment.

The US, which was the largest LNG exporter in the world in 2023, has five LNG export facilities under construction and several more permitted and awaiting a final investment decision. The plants allow operators to chill natural gas to a liquid state that can be shipped in specialized ships to any world city with an import terminal. The US began exporting LNG from its vast shale reserves in 2016, with demand picking up sharply after Russian gas flows to Europe sputtered following the country’s invasion of Ukraine in 2022.

“Should the Biden administration decide to needlessly delay permits for additional LNG exports, it would undoubtedly send a troubling message to our allies and potentially force them to seek supply from bad actors like Russia for LNG supply,” said Charlie Riedl, executive Director of the Center for LNG, a trade group.

But while international buyers are anxious to firm up their energy security with US LNG, not everyone wants to see the gas export expansion take off. Environmental groups and certain Democrats have pushed Biden to reject any further LNG export licenses amid climate concerns. Natural gas’s primary ingredient, methane, is a super-potent greenhouse gas when released without burning; estimates vary wildly on how much leaks out up and down the supply chain.

Environmentalist Bill McKibben, who earlier pushed to block the Keystone XL oil pipeline, has now taken up the campaign against LNG exports. He and other climate activists are planning a three-day demonstration at the Department of Energy in February. The sit-in’s website includes a sign-up form asking participants whether they are willing to risk arrest.

“So far, the DOE has refused to listen to thousands of letters and ignored petitions signed by hundreds of thousands of people. So we need to go to DC to drive home how serious this crisis is,” a letter from the activists released Tuesday reads. It specifically calls out CP2, a proposed plant from Venture Global LNG Inc. in Louisiana that’s awaiting approval by the Federal Energy Regulatory Commission.

Venture Global says its proposed project, like other US plants, will be key to the world’s push to move away from dirtier fuel sources, like coal.

“American LNG is the best weapon in our arsenal to quickly displace global coal use and combat climate change. NGOs and their paid activists have continually misled the public, making up their own facts to fit their agenda, when the data shows otherwise,” Shaylyn Hynes, a spokeswoman for Venture Global, said in an emailed statement.

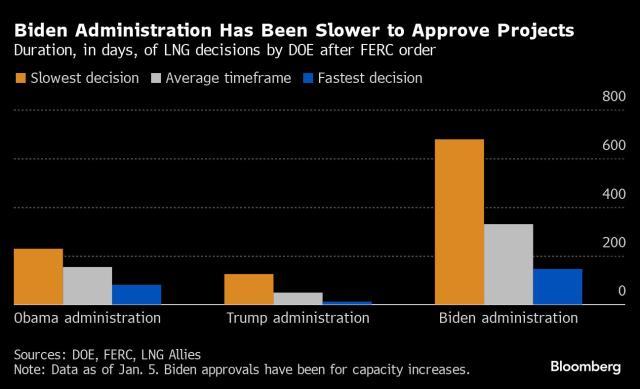

Compared to the two previous presidencies, the Biden administration has taken longer to approve LNG export licenses for new projects, according to data from LNG Allies, a trade group. A longer wait means delays in getting financing and customer commitments, potentially putting projects’ viability at risk.

The proposed Commonwealth LNG project in Louisiana has been waiting more than 400 days for its so-called non-FTA export permit from the DOE.

Compared to the FERC process, “we find there is far less feedback or visibility in DOE’s deliberations for us to understand the delay,” Commonwealth LNG Founder and Executive Chairman Paul Varello said in an emailed reply to questions. “With all our other permits in hand, we’re ready to move forward with the final steps toward financing and construction once the Non-FTA permit is secured.”