The group of eight OPEC+ countries that pledged on 30 November last year to implement voluntary production cuts for the first quarter of 2024 have decided to fully extend the cuts until the end of this year’s second quarter. Saudi Arabia, Iraq, the UAE, Kuwait, Kazakhstan, Algeria and Oman announced on Sunday that the 1.7 million barrels per day (bpd) of voluntary cuts that were initially planned just for this year’s first quarter will not be unwound and will continue next quarter.

Russia, which in November pledged to implement voluntary export cuts (300,000 bpd for crude and 200,000 bpd for fuel products) for the first quarter of this year has announced the implementation of 471,000-bpd voluntary cuts now coming from both crude production and crude exports.

While the common view in the market was that the group would partially extend the cuts into this year’s second quarter in some form, the latest announcement goes above market expectations.

Our assumption was that there would be a prompt unwinding of the voluntary cuts in the second quarter so that OPEC+ crude production would rapidly increase above 36 million bpd by May.

The updated profile now shows OPEC+ crude production at 34.6 million bpd for the whole of the second quarter before increasing to around 36.3 million bpd in the second half of the year.

This new move by OPEC+ clearly shows strong unity within the group, something that was put into question after the November ministerial meeting, which saw Angola leaving OPEC.

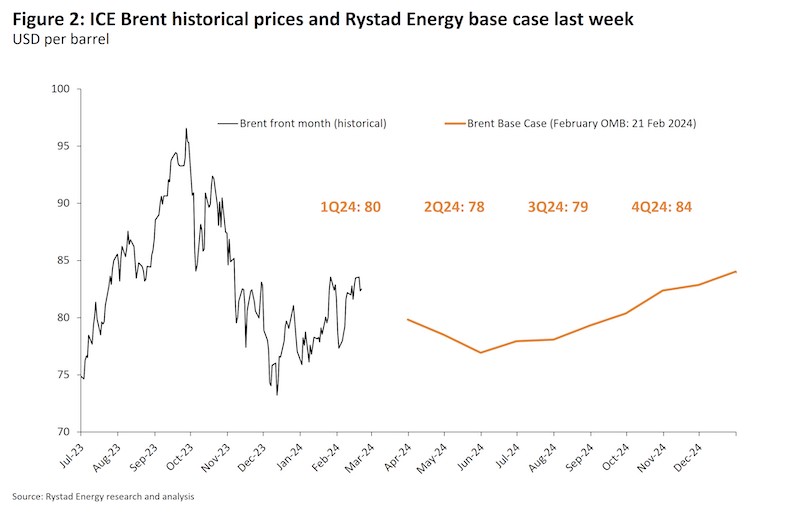

It also shows robust determination to defend a price floor above $80 per barrel in the second quarter. Our market assessment showed that, if OPEC+ rapidly unwound the voluntary cuts, downside price pressure would have accentuated, taking prices down to $77 per barrel in May.

In fact, in that outdated scenario, our liquids balance showed the market rapidly turning from deficit in the first quarter (-1.1 million bpd) to a surplus in the second quarter, particularly in April and May (1.2 million bpd).

The updated market balance now shows that the deficit will continue into the second quarter (-0.9 million bpd), which should add upside price pressure and keep prices above $80 per barrel.

We believe that the resulting upside price in the second quarter will not have a significant impact on demand prospects and will not derail the fight against inflation in Western economies.

At the same time, the impact on US shale production should be marginal.

Looking into the second half of this year, our balances show a strong demand rebound, which implies that no further extension of the voluntary cuts are needed to support prices.

If the voluntary cuts are fully unwound at the end of June, we anticipated a market deficit of around 440,000 bpd in the second half of the year.

Interestingly, OPEC’s latest Monthly Oil Market Monthly (MOMR) report also shows strong demand growth in the second half of this year, with third-quarter demand growing a jaw dropping 2.7 million bpd (y-o-y).

While Sunday’s announcement tightens the oil market and adds upside price pressure, such a move by OPEC+ might also be seen as a sign that demand prospects in the second quarter are less optimistic than the group thought in November last year.

However, OPEC’s MOMR estimates of the demand level for the second quarter have actually increased.

In November, the group estimated demand to average 103.6 million bpd in the second quarter. In its latest report, demand is now estimated at 103.9 million bpd.

The recent increase in geopolitical risk in the market could also be playing a role in this decision.

With increasing uncertainty around the geopolitical situation in the Middle East, particularly following the 29 February incident that saw Israeli troops open fire on Palestinians collecting food aid in northern Gaza, the likelihood of a ceasefire between Israel and Hamas has drastically decreased.

In such an environment, extending voluntary cuts instead of unwinding the cuts provides Saudi Arabia, the UAE and Kuwait with more spare capacity that could be needed if the conflict escalates further, and the market sees actual supply disruptions.