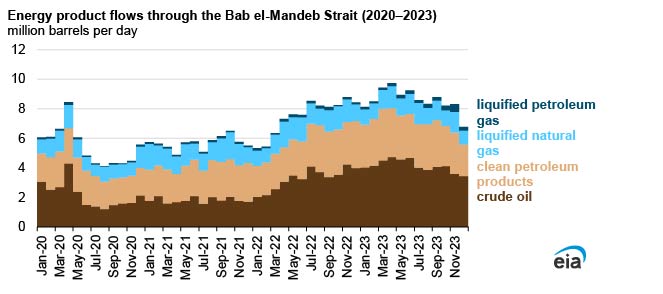

After the attacks began in November, flows of oil, refined products, and natural gas passing through the Bab el-Mandeb Strait slowed. About 18% less crude oil flowed through the Bab el-Mandeb in December than on average from January to November 2023. Most crude oil trade that goes through the Bab el-Mandeb Strait leaves Russia and Iraq en route to Asia and the Mediterranean, respectively. Clean petroleum product flows through the Bab el-Mandeb Strait were 30% lower in December than the rest of 2023. The majority of petroleum product trade leaves Saudi Arabia and India bound for Europe and leaves Russia bound for Asia.

In December, 24% less LNG and 1% more liquefied petroleum gas (LPG) were traded globally compared with the rest of 2023. Vessel restrictions at the Panama Canal due to a drought are causing more VLGCs leaving from the United States to head east toward either the Suez Canal or the Cape of Good Hope. LPG flows through the Bab el-Mandeb increased by 59% in 2023 compared with 2022 because water conservation efforts at the Panama Canal began in January 2023, causing delays and higher costs for VLGCs. The Combined Maritime Forces, a partnership representing 39 nations, warned ships to avoid the Bab el-Mandeb Strait on January 12, which will likely reduce passages through January 2024.

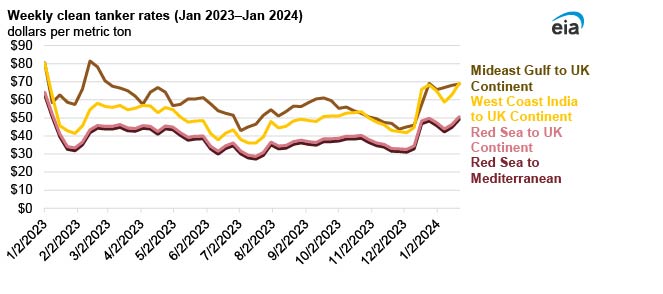

Clean petroleum product tanker rates for routes that cross the Bab el-Mandeb Strait and Suez Canal increased in December 2023 because of the ongoing conflict in the Red Sea. Because routes going through the Red Sea have elevated risk insurance premiums, these costs are passed on to tanker rates. For the four tanker rates that pass through the Red Sea, the average increase was 20% in December compared with November, according to Argus Freight. Long-range 1 tankers traveling from the western coast of India to the UK Continent increased the most (23%), and tankers traveling from the Mideast Gulf to the UK Continent increased the least (16%). Rates for dirty tankers, which mostly transport crude oil, have been relatively unchanged from the elevated prices in November. Brent crude oil spot prices for the week ending November 17, 2023, the week before attacks on ships in the Red Sea began, were $82 per barrel (b). Since then, prices have traded in range, and they closed at $79/b as of January 18, 2024.

_-_28de80_-_58820516bd428ab3fd376933932d068c43db9a4a_lqip.jpg)