Near-term indicators are still flashing red as we move into the final phase of the northern hemisphere winter.

In Europe, Title Transfer Facility (TTF) prices have inched down from $8.8 per million British thermal units (MMBtu) to $8.7 per MMBtu on the week, with Asian spot prices dipping from $9.6 per MMBtu to $9.2 MMBtu week-on-week as demand in East Asia stays muted.

However, a deterioration in the security situation in the Red Sea poses a key geopolitical risk for energy commodities this year, and we discuss the potential impact in more detail in this commentary.

Europe

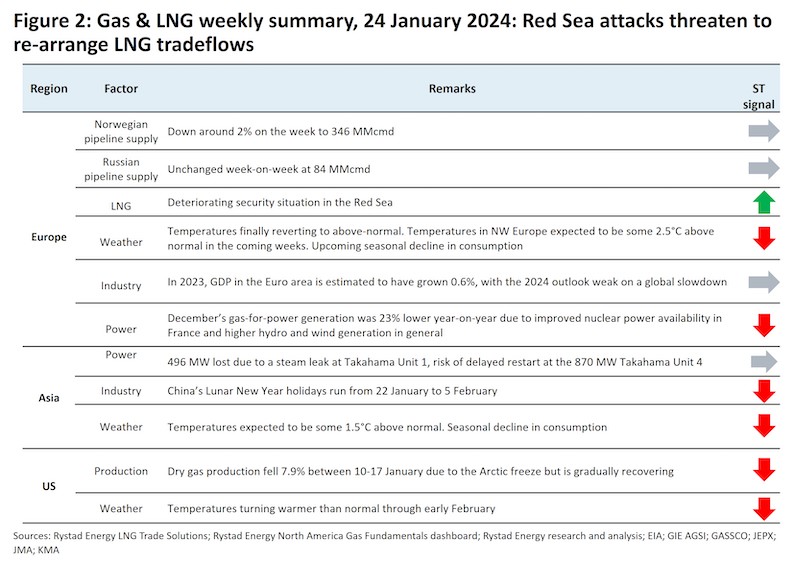

Norwegian gas pipeline supplies are down 3% on the week to around 346 million cubic meters per day (MMcmd).

However, the ramp-up of the Tommeliten-A gas field and debottlenecking at the Kollsnes processing capacity (which increased processing by 6 MMcmd during its extended maintenance last September) is indicative of robust Norwegian supply availability in 2024.

Russian pipeline gas volumes are unchanged week-on-week at 84 MMcmd.

In Russia’s west, Novatek’s Ust-Luga fuel terminal on the Baltic Sea was struck on 21 January by ‘external action’, leading to a suspension of operations.

While this is not a natural gas or LNG facility, the event will raise security concerns over energy infrastructure in the region.

More significantly, the deterioration in recent weeks of the security situation in the Red Sea, where Yemen-based Houthi militia in support of Palestine have disrupted global trade by launching drone and missile attacks on vessels, poses a geopolitical risk to LNG prices.

Qatar Energy suspended shipments through the Red Sea from mid-January and has begun rescheduling shipments with European buyers.

It has now been more two months since the first attack on a commercial vessel, with indications that the attacks could last at least until the Israel-Gaza conflict is resolved – an essentially uncertain duration.

Since mid-January, the US and UK have been drawn into military action in the region, striking Houthi targets inside Yemen.

However, the US are in a difficult position, balancing relations with Israel while avoiding the conflict spillover over into the wider Middle East region.

Recently, the US admitted that Houthi rebels are unlikely to stop their attacks regardless of US action.

For the LNG market, an extended shut-in of the Red Sea route from the Middle East poses a supply risk to Europe (see Figure 1), although the price impact will be delayed until Europe’s gas storage has been drawn down sufficiently.

In 2023, around 15.5 million tonnes (Mt) of LNG was sent through the Red Sea from the Middle East to Europe – a crucial 12.9% of the continent’s LNG supply last year.

Re-routing vessels through the Cape of Good Hope adds around 12.5 days to the voyage each way at 16 knots – which could require an additional 15-20 vessels to deliver the same volume over the year.

This could take the steam off the current bearish pressure on the shipping market, considering spot charter rates have dropped 23% across the month (two-stroke, East of Suez).

However, it will take an increase in LNG prices before we see an increase in charter rates – more than 70 vessels could be delivered this year, representing fleet growth of more than 10% whereas LNG production will only grow 3%.

It is unclear if the prospect of sustained additional voyage time would be acceptable to Qatar, or the prospect of lost canal fees would be acceptable to Egypt.

Northwest Europe has seen temperatures fluctuate widely in January, with the past two weeks tracking at or below the minimum of the 2019-2023 range.

However, even this has failed to support prices, demonstrating the extent of the prevailing bearish sentiment. Further, temperatures are set to bounce up sharply to over 2.5°C above normal in the coming weeks.

The recovery of European industrial gas consumption is also on thin ice – the European Commission reduced its expectations of 2023 gross domestic product (GDP) growth to 0.6% in November, with the outlook for manufacturing in 2024 also remaining weak, linked to the impending global economic slowdown.

As we have mentioned in our monthly reports, gas demand recovery now hinges on lower gas prices, with the ongoing risk of disruptions due to events in the Red Sea a net disservice in this regard.

Gas consumption in Europe’s power sector has also trended down, dropping 23% year-on-year in December due to the material improvement of France’s nuclear power availability as well as higher wind and hydro generation

Asia

The Asian market is characterized by a weakening gas demand outlook in key East Asian markets as the end of winter approaches.

Overall temperatures are set to be some 1.5°C above normal which, coupled with a seasonal decline in heating demand, should put downward pressure on prices.

LNG inventories in Japan and South Korea ended December at 5.4 Mt and 5.3 Mt respectively, near five-year maximums, weakening the outlook for restocking demand in the shoulder season.

However, we are watching for the impact of a possible delay of the restart of the 870-megawatt (MW) Takahama Unit 4 nuclear reactor due to the thinning of heat transfer pipes in its steam generator.

The 826 MW Takahama Unit 1 reactor is also operating at a reduced capacity of 330 MW following a steam leak.

The outlook for Asia’s industrial demand is also weak, with several Chinese industrial users set to reduce activity until after the Lunar New Year holiday ends on 5 February.

By contrast, robust gas purchasing is underway in India and Thailand now that prices have declined to under $9 per MMBtu, including from India’s famously price-sensitive power sector.

Relative to Europe, the impact of the Red Sea disruptions is likely to be limited in Asia.

For US LNG going to East Asia, the voyage through the Cape of Good Hope is only four days longer, while for Yamal LNG, the volume is relatively small (1.55 Mt in 2023).

Trade optimizations between the Atlantic and Pacific basins could reduce the impact even further.

US

We expect little support for Henry Hub prices in the coming weeks as dry gas production has begun to recover after undergoing a sharp 7.9% drop between 10-17 January due to the Arctic freeze.

Front-month prices are currently trading at $2.6 per MMBtu, down from $2.7 per MMBtu a week ago.

Temperature forecasts point to generally warmer-than-normal weather through early February, although we cannot rule out volatility from cold snaps.

Further limiting the impact on Henry Hub prices is fluctuating feedgas intake at US LNG facilities which has averaged 13.8 billion cubic feet per day (Bcfd) so far this January, down from highs of 14.65 Bcfd in December.

However, the near-term Henry Hub forward curve suggests the incentive to maximize production remains in place – full cost deliveries to Europe and East Asia total $6.5 and $8 per MMBtu, respectively – which we expect will provide immediate support to LNG prices in both regions.