There are growing signs that Russia’s oil flows might be facing disruption in the aftermath of a ramp up in US sanctions targeting traders and shipping companies moving the nation’s petroleum.

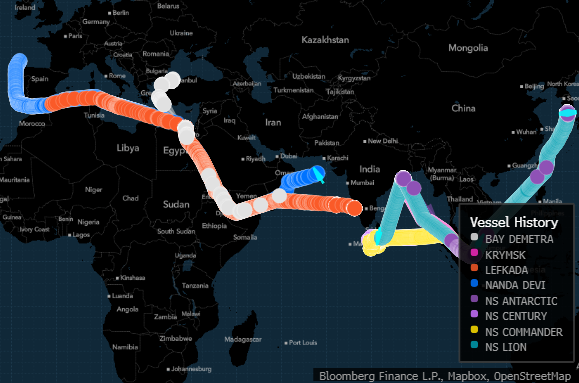

Over the past month or so, a total of 14 tankers hauling the nation’s barrels to India have either been dithering, u-turned or switched off equipment that informs digital tracking systems of their location and what they’re doing over the past month or so.

The fate of the ships will be closely watched by authorities in Moscow and the west. The US is trying to tread a fine line between on the one hand limiting Russia’s access to petrodollars while at the same time maintaining supply. Too great a disruption would jeopardize the latter objective.

The 14 carriers identified by Bloomberg have 11 million barrels of oil on board between them. All were supposed to go to India, where the government said this month that it cut Russian imports because the prices weren’t cheap enough. New Dehli rebuffed speculation about logistical difficulties in paying Russia for the barrels. The majority are the Sokol grade exported from the east of the country but some flagship Urals cargoes are held up too.

The signs of possible disruption come just weeks after the US Treasury imposed its most wide-ranging sanctions on Russian oil traders and state shipping company Sovcomflot since the war on Ukraine began.

They did so against signs that Russia was increasingly using mystery traders and a huge fleet of ships with uncertain ownership and insurance to beat a Group of Seven price cap that was meant to hurt the Kremlin.

Some of the 14 ships appear to have gone out of signal, meaning they may simply be delivering cargo in secret. However, it has been relatively unusual to see tankers involved in the Russian oil trade do this since the war in Ukraine began.

India’s oil ministry spokesman didn’t immediately reply to email and text message seeking comments.

Russia has been the biggest supplier of crude to India over the past year, but its imports have plunged since the summer.

The Indian government has denied that the drop is related to payment challenges, blaming instead the high price of Russian barrels relative to other grades. But the latest decline comes after the US signaled it will ramp up enforcement of a price cap and wider sanctions on Russia.

At least one Indian refiner had to buy Abu Dhabi’s Murban crude to replace disrupted Russian imports.

Many Sovcomflot tankers are still heading to India without interruption, including nine loaded with Urals.

So far there have been no signs of delays to those ships’ voyages, but any issue may not become apparent until they are closer to their intended destinations.