Taiwan throws in towel on 2015 global export recovery as September shipments crumble

By: Reuters | Oct 07 2015 at 03:24 PM | International Trade

Trade-reliant Taiwan effectively wrote off any chances of a global export recovery this year after its September shipments tumbled more than expected, with weakening in all of its major markets, particularly China.

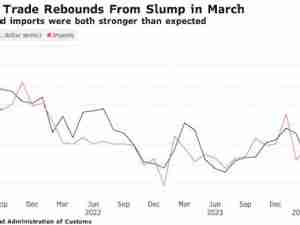

Exports sank last month for the eighth month in a row and at the second-fastest pace in over two years, reinforcing the rationale behind the central bank's decision to cut interest rates last month for the first time since the global crisis.

The dismal report will reinforce signs of a growing chill in global demand. Taiwan is a major exporter of electronics and parts for gadgets like smartphones, which are usually in strong demand heading into the year-end shopping season.

September exports, however, showed a further deterioration in demand rather than any signs of a seasonal bounce, falling 14.6 percent from a year ago, worse than expectations for an 11.6 percent decline in a Reuters poll.

Taiwan's finance ministry said it expected exports to continue to fall in the fourth quarter from a year earlier, though it predicted the rate of decline would begin to ease in October. Still, it said an expected recovery for the semiconductor industry will be delayed into early 2016.

The world's largest contract chipmaker, Taiwan Semiconductor Manufacturing Co , said last month fourth-quarter revenue was likely to be little changed from the third-quarter.

While a recent selloff in global financial markets was attributed largely to worries about China's slowing economy, a breakdown of Taiwan's sales point to weakening demand in all major markets.

Exports to China fell 17.1 percent, more than double the decline in August, with shipments to Japan sliding 15.1 percent. August's growth in exports to the U.S. and Europe vanished, with falls in those markets of 0.4 percent and 9.4 percent, respectively, last month.

Electronics exports and information and communication exports fell 9.9 percent and 22.1 percent, respectively, indicating weak demand for the island's signature goods.

Taiwan's exports only reflect a portion of what is produced on the island because many orders are farmed out to factories owned by Taiwan firms in China. As a result, the poor readings could portend further weakness in China's export data next week.

Import Weakness Well

Taiwan's imports also fell at a sharper-than-expected pace in September, reflecting lower global commodity prices but also softening demand at home.

Imports slumped a greater 24.4 percent last month from a year earlier, compared to the 16.7 percent drop recorded in August, pushing the trade surplus to $5.25 billion for September, ministry data showed.

The government in August cut its growth forecast for gross domestic product (GDP) this year to 1.56 percent, which would be the slowest in six years. At the same time, it estimated the gain in the third quarter - traditionally the ramp-up to peak holiday demand - would be just 0.1 percent.

The annual forecast, already cut from a high of 3.78 percent estimated earlier this year, may still be too optimistic.

Last week, Taiwan's chief statistician said it would difficult to achieve 1 percent growth in the full-year for 2015, when asked by Taiwanese lawmakers if third-quarter GDP shrank.

Su-mei Shih, minister of the Directorate General of Budget, Accounting and Statistics, said the government will cut its 2015 GDP estimate again next month. (Reuters)