The U.S. and the U.K. banned the import of Russian oil while the European Union is considering issuing joint bonds to help counter the fallout from President Vladimir Putin’s invasion of Ukraine.

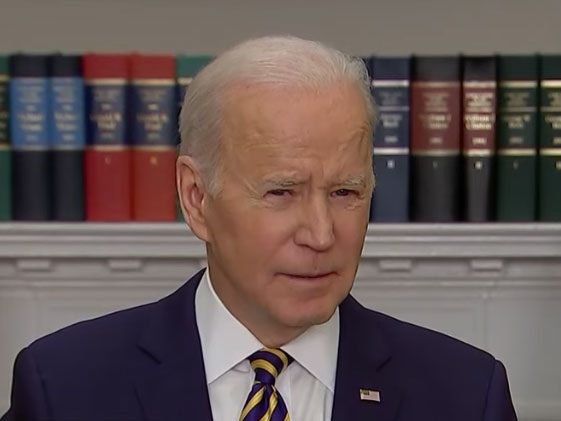

President Joe Biden announced measures against Russian oil, LNG and coal Tuesday while the U.K. plans to phase in the restrictions over several months. The U.K. ban won’t affect gas imports.

The EU, which is more heavily reliant on Russian energy, has been split on whether to halt energy imports from Russia with Germany particular concerned about the economic impact. The European Commission is set out its plans to end the EU’s reliance on Russian energy Tuesday.

Key Developments

- U.K. to Phase Out Russian Oil Imports in Latest Sanctions Move

- Biden Set to Ban U.S. Imports of Russian Oil as Soon as Today

- China Considers Buying Stakes in Russian Energy, Commodity Firms

- EU to Consider Massive Joint Bond Sales to Fund Energy, Defense

- Russian Threat to Cut Gas Sends European Market Into Frenzy

- Russia Surges Past Iran to Become World’s Most-Sanctioned Nation

All times CET:

Swedish Premier Says a Push to Join NATO Would Add to Instability (5:30 p.m.)

Sweden’s prime minister cooled speculation about any near-term bid to join the NATO alliance despite a surge in public support for such move.

“If Sweden would choose to file an application to NATO in this situation it would further destabilize this part of Europe,” Prime Minister Magdalena Andersson said at a press briefing on Tuesday. “My assessment is clear: sticking to Sweden’s long-standing, consistent policy is what serves our security best.”

Italy Prepared to Back More EU Sanctions Against Russian Banks (5:20 p.m.)

Italy is ready to support a third EU package of sanctions that would expand the list of targeted banks and billionaires in a bid to pressure Russia into a ceasefire, Foreign Minister Luigi Di Maio said an interview with Bloomberg.

The EU won’t give in to “Russia’s blackmail” on energy, Di Maio said, referring to a threat to cut natural gas supplies to Europe via the Nord Stream 1 pipeline. Di Maio has traveled to Algeria and Qatar in recent days to discuss more gas supplies from those countries and lower Italy’s reliance on Russia. Italy gets 40% of its gas imports from Russia.

U.K. Joins U.S. Move to Ban Russian Oil Imports (4:05 p.m.)

The U.K. is set to announce a ban on Russian oil imports following coordination with the White House, according to an official briefed on the government’s plans.

The U.K. restrictions will only affect oil—the U.S. measures are set to also block LNG and coal shipments—and will be phased in over several months, the official said. Biden is due to set out more measures against Russia at 4:45 p.m. CET (10:45 a.m. eastern time).

German Refinery Limits Supplies, Continental Halts Russian Plants (3:22 p.m.)

OMV AG is limiting the supply of heating oil and diesel from its refinery near Munich in southern Germany in a fresh sign of strains in energy supplies. The company has also stopped its normal practice of releasing daily spot prices.

Continental AG is halting operations in Russia where it employs about 1,300 people, DPA reported. All shipments to and from Russia have also been stopped, the agency said.

Biden’s Plan to Ban Russian Oil Hits Stocks, Spurs Crude (2:32 p.m.)

U.S. futures fell along with stocks in Europe as the Biden administration prepares to impose a ban on U.S. imports of Russian energy. Treasury yields rose and crude oil climbed. Contracts on the S&P 500 and Nasdaq 100 turned lower, signaling little respite for stocks whipsawed by the fallout from the invasion. The Stoxx Europe 600 index declined, reversing an earlier gain of as much as 1% after Bloomberg reported that the European Union is considering joint bond sales. The 10-year Treasury yield jumped along with its German counterpart. Oil in New York pushed past $124 a barrel.

Biden Set to Ban U.S. Imports of Russian Oil as Soon as Today (2:10 p.m.)

The Biden administration is poised to impose a ban on U.S. imports of Russian energy as soon as Tuesday, moving forward on the measure without European allies, according to people familiar with the matter.

The ban will include Russian oil, liquefied natural gas and coal, according to two people, who spoke on condition of anonymity. The decision was made in consultation with European allies, who rely more heavily than the U.S. on Russian energy, another person said.

U.S. Senators Seek to Bar Russia Selling Gold to Dodge Sanctions (1:52 p.m.)

A bipartisan group of U.S. senators has introduced a bill to impose secondary sanctions on anyone buying or selling Russian gold in an effort to block one of Moscow’s remaining possible avenues for offsetting the collapse of its currency.

A number of senators launched the legislation to stop anyone transacting with or transporting gold from Russia’s central bank holdings or selling gold physically or electronically in Russia. Russia’s gold stockpile was valued at $132.3 billion at the end January.

EU Urged to Vaccinate Ukrainian Refugees for Covid (1:33 p.m.)

EU countries should work to help vaccinate Ukrainian refugees against Covid-19 and other preventable diseases, the bloc’s infectious diseases agency said in a report Tuesday. The report noted that only 35% of Ukraine’s population was fully vaccinated against Covid, well below the EU’s average of more than 70%.

“Vaccination acceptance also needs to be assessed and addressed among those fleeing Ukraine,” the European Centre for Disease Prevention and Control said.

China Considers Buying Stakes in Russian Firms (12:31 p.m.)

China is considering buying or increasing stakes in Russian energy and commodities companies, such as gas giant Gazprom PJSC and aluminum producer United Co. Rusal International PJSC, according to people familiar with the matter.

Beijing is in talks with its state-owned firms, including China National Petroleum Corp., China Petrochemical Corp., Aluminum Corp. of China and China Minmetals Corp., on any opportunities for potential investments in Russian companies or assets, the people said. Any deal would be to bolster China’s imports as it intensifies its focus on energy and food security—not as a show of support for Russia’s invasion in Ukraine—the people said

China Willing to Coordinate With Europe on Ukraine (12:34 p.m.)

President Xi Jinping said China is willing to coordinate with Europe on the crisis in Ukraine, holding a video call Tuesday with the leaders of France and Germany.

Xi’s comments, carried on state media, echo the narrative from China in recent days that it supports a mediated solution to the conflict and for Russia and Ukraine to hold talks. China has indicated growing concern about the humanitarian crisis in Ukraine and the safety also of Chinese citizens there.

Xi repeated China’s view that further sanctions on Russia would damage other countries and the global economy, state media reported. China has largely sought to avoid taking a position in the conflict and has not condemned Russia for its actions.

Shell to Stop Spot Purchases of Russian Crude (11:44 a.m.)

Europe’s largest oil company made a U-turn on buying Russian oil in a move that shows how toxic the nation’s barrels have become.

Just days after purchasing a cargo of the country’s flagship crude—and saying it did so to keep fuel supplies up—Shell Plc announced it is halting spot purchases and phasing out all buying. Shell also said its refineries will cut the amount of oil passing through them, meaning less fuel for consumers.

Shell’s trade on Friday drew heavy criticism, including from Ukrainian Minister for Foreign Affairs Dmytro Kuleba took to Twitter to ask the company whether the oil smelt like “Ukrainian blood for you?” On Monday, Total said its traders would also stop buying Russian crude.

EU Aims to Sanction 14 More Wealthy Russians (11:27 a.m.)

The EU will propose a new round of sanctions that would target a total of 14 individuals, including several wealthy Russians and their family members, but will stop short of more far-reaching steps like penalizing ports, according to several diplomats.

The latest round of sanctions would also target at least one entity as well as more than 100 members of the upper house of the Russian Parliament, who have voted in favor of measures backing the war.

Ukraine Says Russia Hampers Mariupol Aid Effort (11:17 a.m.)

Ukraine was getting reports of Russian shelling in the vicinity of trucks carrying aid to Mariupol, which is surrounded by Russian forces. A humanitarian corridor opened earlier Tuesday, with 90 tons of aid and 30 buses leaving Zaporizhzhya to relieve civilians trapped in the port city.

“We are counting on obligations that Russia has taken” to allow the delivery of food, water and medicine to Mariupol and to evacuate people, Ukrainian Deputy Prime Minister Iryna Vereshchuk said. “If the shelling continues or harms anyone, we will appeal to international tribunal.”

Number of Ukrainians Fleeing Reaches 2 Million (10:39 a.m.)

The war in Ukraine has triggered an exodus of 2 million refugees less than two weeks since Putin ordered the invasion, according to Filippo Grandi, the United Nations High Commissioner for Refugees.

The UNCHR said on its website that some 1.2 million alone had fled to neighboring Poland since Feb. 24, with Hungary taking in more than 190,000.

Zelenskiy Ready to Discuss Fate of Separatist Areas (10:35 a.m.)

President Volodymyr Zelenskiy indicated he was prepared to discuss territorial matters, including the future of two separatist areas in eastern Ukraine that Russia recognized as independent as a prelude to Putin’s invasion.

But he made clear he is not ready to meet Putin’s demands, which are for a rewrite of Ukraine’s constitution to give those territories full independence.

“We can discuss and find compromise on how these territories will live on,” Zelenskiy said in an interview with ABC TV on Monday that was aired in part by Russia media on Tuesday. “I’m ready for dialogue, we’re not ready for capitulation.”

Zelenskiy referred to the territories as “pseudo-republics,” or temporarily occupied territories, unrecognized by anyone but Russia. “So the question is more difficult than simply acknowledging them,” he said. “This is another ultimatum and we are not prepared for ultimatums.”

Europe, U.S. Stocks Rally on EU Bond Plan (10:07 a.m.)

Stocks in Europe rallied along with U.S. futures after Bloomberg reported that the European Union is considering joint bond sales to help counter the fallout from Russia’s invasion of Ukraine. Bonds dropped and the euro strengthened.

The Stoxx Europe 600 index reversed an early decline to climb more than 1%, set for its first advance in four days as the possibility of further central-bank stimulus lifted sentiment. Futures on the S&P 500 and Nasdaq 100 also turned higher. The 10-year Treasury yield jumped seven basis points and those on German bunds rose nine basis points. The spread between 10-year Italian and German yields—a key gauge of risk in the euro region—tightened.

G-7 to Discuss War’s Impact on Food Security (9:35 a.m.)

Germany will host a special meeting of agricultural ministers from Group of Seven countries on March 11 to discuss the war’s impact on global food security and how to stabilize markets, the agricultural ministry said in a statement.

Euro Strengthens on EU Bond Plan (9:32 a.m.)

The euro strengthened against the dollar and European stocks turned higher after Bloomberg reported that the EU is considering joint bonds to help cope with the impact of the war.

European bonds declined, with the yield on German bunds rising almost seven basis points.

EU Mulls Joint Bond Sales For Energy, Defense (9:19 a.m.)

The European Union will unveil a plan as soon as this week to jointly issue bonds on a potentially massive scale to finance energy and defense spending in the 27 member states as the bloc copes with the fallout from Russia’s invasion of Ukraine.

The proposal may be presented after the bloc’s leaders hold an emergency summit in Versailles, France, March 10-11, according to officials familiar with the preparations. Officials are still working out the details on how the debt sales would work and how much money they intend to raise.

German Manufacturer Suspends Guidance (8:30 a.m.)

German auto parts supplier Schaeffler AG suspended its earnings guidance for this year, saying Russia’s invasion of Ukraine makes business activity and supply chains impossible to assess—the latest sign of the impact of the conflict across the global economy.

The development of raw materials, freight rates, energy prices, inflation and global economic development has become unpredictable, the maker of ball-bearings and transmission components said on Tuesday.

Schaeffler Suspends Earnings Guidance on War in Ukraine

Gas Jumps as Russia Threatens to Close Nord Stream (8:35 a.m.)

European gas futures jumped as much as 32% after Russia threatened to cut natural gas supplies to Europe via the existing Nord Stream pipeline, adding pressure to commodity and energy markets roiled by the invasion.

Wheat fluctuated near an all-time high, after exceeding levels seen during the global food crisis in 2008, as traders assessed the impact of Russia’s war in Ukraine, which has cut off one of the world’s top breadbaskets.

Nickel surged as much as 111% amid a short squeeze. Russia’s Norilsk Nickel is a major producer of the metal, used to produce stainless steel and automobile batteries.

European Gas Futures Surge 30% as Russia Threatens to Cut Flows

Russian Top Energy Official Threatens Pipeline (9:29 p.m.)

Russian deputy Prime Minister Alexander Novak threatened to cut off natural gas supplies to Europe through the Nord Stream 1 pipeline in retaliation for Germany’s decision to block operation of the new Nord Stream 2.

In a televised statement, Novak, also the country’s top energy official, said Russia hasn’t made the decision yet but has the full right to take a “mirror” action and stop supplies that come through the pipeline, which he said is working now “at its full capacity.”

Last month, Berlin shelved the $11 billion Nord Stream 2 pipeline project that was designed to bring steady gas supplies from Russia. His warning comes as Europe is vowing to cut its reliance on Russian gas by almost 80% this year.

U.S. Lawmakers Coalesce Around Oil Ban (9:12 p.m.)

The framework agreement among key lawmakers comes amid mounting pressure to enact a ban tightening economic pressure on Russia. The House of Representatives could vote on the proposal as soon as Wednesday, but President Joe Biden hasn’t endorsed the effort.