United Parcel Service Inc. soared the most in almost nine months after profit rose far beyond what Wall Street expected, buoyed by strong, broad sales growth as the rollout of Covid-19 vaccines helped stimulate the economy.

First-quarter adjusted earnings reached $2.77 a share, UPS said in a statement Tuesday, rising from $1.15 a year earlier when the first coronavirus wave began closing businesses. Analysts had predicted a profit of $1.73 a share for the latest quarter, according to the average of estimates compiled by Bloomberg.

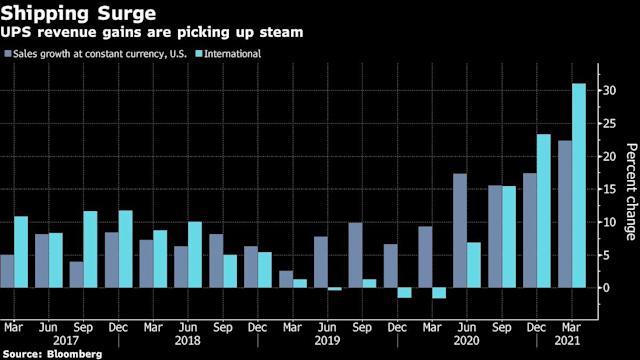

Sales climbed 27% to $22.9 billion while analysts anticipated $20.6 billion.

“The significant across-the-board beat is almost too big to be true,” Brian Ossenbeck, an analyst at JPMorgan Chase & Co., said in a note to clients. “Concerns of peak pricing and tougher comps will linger, but the U.S. domestic operations are clearly operating at a higher level of profitability.”

Chief Executive Officer Carol Tome has taken advantage of strong sales to push a “better not bigger” strategy, moving to boost margins by paring e-commerce business from less profitable large retailers rather than adding capacity to meet all demand. The company instead has focused on smaller customers and health-care deliveries, which helped drive up first-quarter revenue per package by 10% for the international and U.S. operations.

UPS jumped 11% to $194.76 at 11:44 a.m. in New York to easily top the S&P 500. The stock earlier advanced 12%, the most intraday since July 30. UPS had climbed 4.4% this year through Monday, while the index advanced 11%

The courier’s results have climbed as the Covid-19 pandemic drove consumers to purchase more goods online. A steep drop in airline flights, which typically carry some international air freight, meanwhile allowed the courier to raise prices. The only major drag during the pandemic has been a decline in commercial service. But recent economic growth is reviving that traffic, which is more profitable than residential shipping.

Commercial package volume in March finally turned positive from a year earlier after being depressed by lockdowns, UPS said.

“We look forward to the economy continuing to recover and our commercial business coming back as well,” Tome said on a conference call with analysts.

UPS’s results followed a similarly robust earnings report by rival FedEx Corp. last month. FedEx rose 4.5% to $289.37 Tuesday.

What Bloomberg Intelligence Says

“Revenue, margin and earnings expectations for UPS need to be recalibrated higher, in our view, as the company’s 1Q results illustrate that it’s hitting its stride. UPS’s adjusted EPS of $2.77 was 60% above consensus on revenue that was 11% ahead of analysts’ forecasts.”

UPS’S adjusted operating margin rose to 12.9% from 6.2% a year earlier, reaching its highest level since the second quarter of 2016. Tome in February said the company had passed a “turning point” for improving margins.

The revenue gain was led by the international unit, which was hit first last year by China’s lockdowns, jumping 36% to $4.6 billion. Sales jumped 22% to $14 billion at the Atlanta-based company’s main U.S. business, driven by small and midsize businesses.

The company declined to provide forecasts for 2021 revenue and profit, citing “continued economic uncertainty” and saying it would provide more detail at its June 9 investor meeting.