The world desperately needs more grains to help temper rampant food inflation, yet there are signs that the US, a key producer, will ship the smallest amount of wheat in 50 years.

American wheat is too expensive and sales have been slow, the US Department of Agriculture said in its monthly supply-and-demand report. Adverse weather across parts of the US breadbasket have limited harvests, and low water levels along the Mississippi River are making it slower and more expensive to get crops to export terminals. As a result, domestic reserves are piling up more than expected. Corn, soybean and rice export outlooks were also weaker.

It all points to less availability for world markets, which are depending on countries like the US to supply much-needed grains as disruptions from the war in Ukraine cut off shipments from the important Black Sea region. Other major shippers are also having problems getting grains out for export, like Canada, which is experiencing rail car shortages.

The report “was aggressive in lowering demand,” led by exports, said Terry Reilly, senior analyst at Futures International LLC in Chicago.

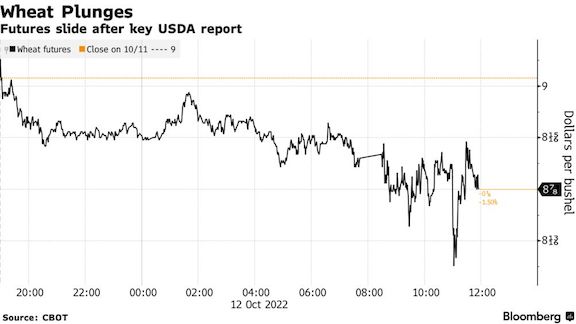

US wheat exports were lowered 50 million bushels to 775 million, the lowest since 1971. Benchmark futures in Chicago fell as much as 2.8% to $8.7625 following the report.

Global food prices have touched records in recent months as inflation ripples through economies and hunger levels rise. The cost of growing food in the US is set to rise by the most ever in 2022.

The report also comes with Russia escalating attacks on Ukraine and fears of a global economic slowdown, which are putting commodities markets on edge. Warnings about an unfolding food crisis are adding pressure on farmers just as new wave of weather woes hit worldwide and the US faces a drought-driven slowdown in getting exports to the world market.

Meanwhile, corn futures dropped after the report signaled bigger stockpiles. Soybeans jumped sharply, as much as 2.7%, the most in a month, as US ending stockpiles came in much lower than expected.