Air cargo rates are rising from most of the main global regions, especially from Asia Pacific and from Middle East & South Asia (MESA), strengthened by the ongoing disruptions to container shipping and elevated demand for cross-border e-commerce shipments.

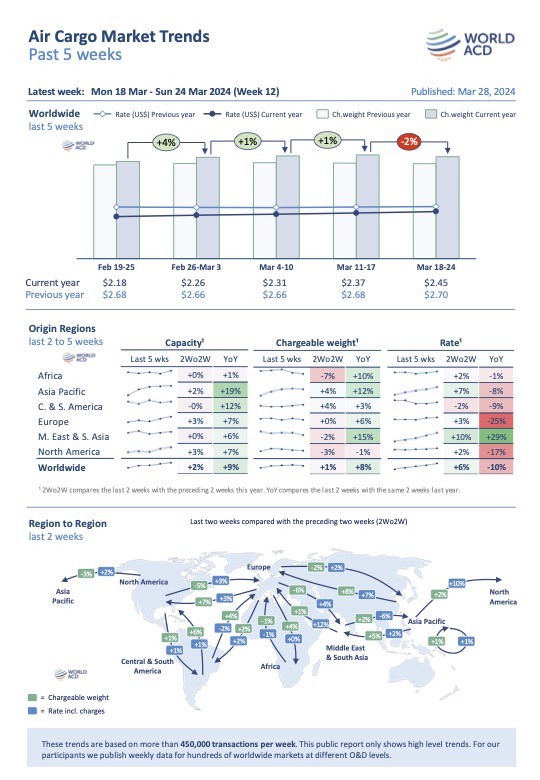

According to the latest weekly figures and analysis from WorldACD Market Data, the average global rate rose by around +3% in week 12 (18-24 March) to $2.45, which is within 10% of its elevated level this time last year. Although global tonnages in week 12 were slightly down (-2%) compared with the previous week, tonnages for the last two weeks (weeks 11 and 12), combined, are up +1% compared with the previous two weeks (a 2Wo2W comparison), and average rates are up by +6%, 2Wo2W, with capacity up by +2%.

That +6% increase in rates, 2Wo2W, was mainly driven by rises of +10% from Middle East & South Asia, and +7% from Asia Pacific origin points.

Year-on-year growth

Six weeks on from Lunar New Year (LNY), year-on-year (YoY) comparisons are now more meaningful and reveal some significant improvements in demand levels compared with this time last year, based on the more than 450,000 weekly transactions covered by WorldACD’s data. Overall global tonnages are up by +8%, YoY, led by a +15% rise from Middle East & South Asia and a +12% rise from Asia Pacific origin points, as disruptions to Asia-Europe container shipping – caused by the attacks on vessels in the Red Sea – and strong e-commerce demand continue to bolster air cargo demand from those regions. But there is also YoY growth ex-Africa (+10%), ex-Europe (+6%) and ex-Central & South America (+3%), with North America the only origin region to record a slight decline (-1%).

Worldwide average air cargo rates are down, YoY, by -10%, but they remain significantly above pre-Covid levels (+36% compared to March 2019).

Overall worldwide air cargo capacity continues to be significantly up on last year’s levels (+9%), most notably ex-Asia Pacific by +19%, and ex-Central & South America by +12%.

Middle East & South Asia growth

As WorldACD has highlighted in recent weeks, one of the big ongoing stories at the moment is the continuing surge in demand and rates from MESA origin points. With tonnages up +15%, YoY, and capacity up by +6%, it’s the only major origin region to also record YoY increases in average rates, which are up by +29%, YoY, in weeks 11 and 12 combined, as well as increasing by +10% compared with the previous two weeks.

As also recently highlighted, certain Asia-Europe sea-air hubs such as Dubai, Colombo and Bangkok have experienced exceptionally high air cargo demand to Europe since the start of this year, in large part linked to the disruptions to Asia-Europe container shipping caused by the attacks on vessels in the Red Sea.

Fresh analysis this week indicates that Dubai-Europe tonnages remain particularly strong, up by +162% in weeks 11 and 12, combined, compared with their level this time last year, and Bangkok-Europe tonnages remain significantly elevated, up by +46%, YoY in weeks 11 and 12.

Also, Colombo-Europe tonnages were up +22%, year on year (YoY), in weeks 11 and 12. That is similar to week 10 (+24%), but only half the level of week 9 (+38%) and a quarter of the level the three weeks before (more than +80%).

Analysis last week by WorldACD also revealed that the recent disruptions to container shipping have contributed to a big surge in average air freight rates from South Asia as a whole, with, currently, average rates from South Asia into Europe up by +66% for the period 1-24 March compared with December 2023, and up by +39% into North America.

Eastern Mediterranean changes

A separate analysis by WorldACD suggests that disruption to container shipping to and from the eastern Mediterranean region may have contributed to higher air freight traffic from airports in that region to the MESA region.

Particularly, tonnages from Athens went up year on year markedly since November 2023, starting at +8%, with a peak in February at +73%, and so far for March at +22%. A similar trend was seen for origin Istanbul, starting at +1% in November 2023, to +54% in February, YoY, and so far for March +30%. Into Dubai, traffic went up even stronger from these two origin points, and currently in March by +35% and +102%, respectively.