Yen strengthens as drop in China’s exports spurs haven demand

By: Narayanan Somasundaram and Marianna Aragao | Oct 13 2016 at 07:14 AM | International Trade

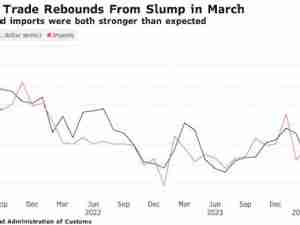

The yen rallied from the weakest level since July after a bigger-than-forecast drop in Chinese exports undermined confidence in the global economy and spurred investors to seek havens.

Japan’s currency rose against all of its 31 major counterparts on the latest signs of a slowdown in the world’s second-largest economy. The euro briefly fell below $1.10 for the first time since July. A gauge of the dollar dropped, after being supported earlier by yesterday’s Federal Reserve policy meeting minutes, which showed several officials back an interest-rate increase “relatively soon.”

“Chinese trade data was disappointing,” said Sim Moh Siong, a currency strategist at Bank of Singapore Ltd., based in the city state. “The Fed is also paying attention to the rest of the world and, if the Chinese situation is not as strong as what people think, then the Fed may move more cautiously. That may undermine the dollar’s strength.”

The yen advanced 0.4 percent to 103.75 per dollar as of 7:10 a.m. New York time, after sinking earlier to the weakest level since July 29. The euro dropped to $1.0985, before rebounding.

Biggest Partner

Australia’s dollar declined to a three-week low after China—the Antipodean nation’s No. 1 trading partner—also reported a drop in imports. The Aussie slipped 0.1 percent to 75.52 U.S. cents.

The chance of an increase in U.S. borrowing costs by year-end remained at 68 percent after the release of the minutes, according to fed fund futures, though that’s up four percentage points from a week ago. The bets are being supported by better-than-predicted U.S. data from manufacturing to services, coupled with concern inflation will accelerate and encourage the Federal Open Market Committee to act.

The Chinese exports numbers were “disappointing” and the “main catalyst for a risk-off move,” said Adam Cole, head of global foreign-exchange strategy at Royal Bank of Canada in London.