The US-China trade dispute is shifting the supply and demand channels for the forest product industry.

Sans oil, there are few commodities whose trading complexities rival forest products. It is a ubiquitous commodity essential to modern civilization. As is the trade in forest products, which is caught in the maelstrom of an ever-widening trade war.

In the case of forest products, it is really a trade war on two fronts with global ramifications: Canada and China. Each dispute is quite different from the other, aside from the Trump Administration view that the United States has been treated unfairly by their trading partner.

In the case of Canada, the disagreement over softwood lumber exports to the U.S., almost surprisingly, pre-dates President Trump. (See Leo Ryan on this page) And in China’s case, forest products are simply part of the much wider political and economic quarrel between Washington and Beijing.

Tariffs - A Knotty Problem

Even as this article is being written, another escalation in the U.S.-China trade war of dueling tariffs is to commence. On September 17th, the U.S. announced it would impose tariffs on another $200 billion in Chinese imports. In a statement, President Donald Trump announced he has directed U.S. Trade Representative Robert Lighthizer to impose the new tariffs in response to what he said are unfair trade practices by China. The tariffs will take effect on September 24th at an initial rate of 10%. This rate will increase to 25% on January 1st if no agreement is reached between the two economic super powers. Chinese Foreign Ministry spokesperson Geng Shuang said China “will have to take necessary countermeasures.” Among the “counter measures”, China announced September 18th it would levy a 10% tariff on LNG exports – a move that could easily make US LNG from the Gulf uncompetitive with potential imports from the Middle East or Australia.

With the new tariffs, the Trump Administration has placed a tariff on $250 billion worth of Chinese goods or approximately half of the value of China’s exports to the US. China has retaliated with tariffs amounting to the same amount and threatened another $60 billion in retaliation for the new round of tariffs.

Following the Trump Administration’s July tariff, China announced in August tariffs on a wide range of commodities ranging from 5% to 25%. Included in China’s August list for duties was lumber and hardwoods. The duties would be on both low-grade and grade hardwoods and lumber - most U.S. exports are grade. The tariffs are expected to be implemented in October.

Trade On & Offs

U.S. forest products exports rose 9% in 2017, compared to only a 1% increase in 2016 and a sharp 16% drop in 2015. The main reason for the rebound was China. Exports to China, the largest U.S. trade partner for forest products, were up 21% from 2016. Producers of southern yellow pine exported 41% more to China in 2017 than they did in 2016.

But softwoods weren’t alone in the rebound. The import value of US hardwood products to China reached a record high of US$323 million in 2017, up 3.4% year on year. In the first quarter of this year, the export value hit US$138 million, an increase of 36.7% year on year, according to statistics from the American Hardwood Export Council (AHEC).

Currently, U.S. hardwoods amount to about 10% of Chinese imports, according to the AHEC. Last year, shipments to China included US$1.6 billion in hardwood lumber, $800 million for hardwood logs and $260 million for veneer.

The impact the tariffs have had on wood product trade between the U.S. and China is just beginning to show statistically. According to China Customs, the value of wood products trade between China and the U.S. fell 16% in March 2018 with wood product imports dropping by 5%. However, during the first quarter of 2018, China’s wood product exports, grew by 9% with imports climbing 6% to $2.28 billion and exports 10% to $3.98 billion.

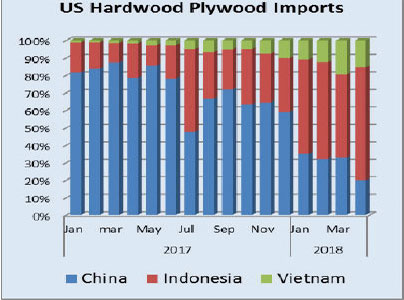

But on some wood products the tariffs are having an effect. Late last year the U.S. hit China’s plywood industry with countervailing duties after a Commerce Department analysis showed the engineered panels were being sold at its cost below cost of manufacture. In 2017 the International Trade Commission (ITC) issued its final determination, activating significant tariffs - nearly 200%- on some imports of Chinese hardwood plywood, voting 4-0 that the US domestic industry is materially injured, or threatened with material injury, by reason of these dumped and subsidized imports.

Since the duties, China’s fiberboard exports to the U.S. fell 11% to 71,200 cu/m and plywood exports to the U.S. dropped 31% to 360,000 cu/m in the first three months of 2018.

Even before the tariffs China’s imports of forest products had begun to shift.

Since 2016, China’s imports of lumber grew much faster than logs. According to the Wood Quarterly Review, in 2017 China’s lumber import volumes eclipsed log import volumes by 36%. In prior years, shipments of logs were substantially larger than lumber.

Beneficiaries of Trade War

With the U.S. and China embroiled in an escalating trade dispute, other nations are benefiting. New Zealand and Russia are now the largest supplier of logs to China.

In the first quarter of 2018, New Zealand accounted for 25% of total log imports. Imports from New Zealand totaled 3.66 million cu/m in the first quarter of 2018, a year on year increase of 16%. The average prices for imported logs from New Zealand rose 12% to US$142 per cu/m.

Russia also benefited by supplying 2.86 million cu/ft or about 21% of China’s imports, although the tally was marginally down 1% in the 1st quarter of 2018.

Other countries have also increased their shipments. Nigeria and Indonesia are the main suppliers of Chinese ‘‘redwood’’ – wood used in making furniture and other retail wood products. Chinese ‘redwood’ log imports totaled 990,000 cu/m, worth $914 million in 2017, up 24% in volume and 12% in value.

Around 45% of Chinese “redwood” log imports were from Nigeria in 2017 despite the log export ban and were worth US$329 million. Other countries like Vietnam and Malaysia have similarly benefited from China’s purchases.

Currently China’s furniture makers and other wood processing manufacturers are undergoing a structural change similar to the experience in the iron and steel industry. Modernization – particularly moving from coal to gas or oil – in the plants is forcing older manufacturers out of business. The industry dislocation is dumping product into the market as was noted in the ITC manufactured wood decision.

With the trade war escalating, it is likely that both China’s inputs like lumber and logs will come from sources other than the U.S. and outputs like furniture and manufactured wood products will seek markets other than the U.S.