By the Numbers

Trade deficit in U.S. widens to a record as exports decline

Bloomberg | November 04, 2021 | International Trade | By The Numbers

The U.S. trade deficit widened to a record in September, reflecting a pickup in imports and a drop in exports that show a pandemic recovery further along than many other economies around the world.

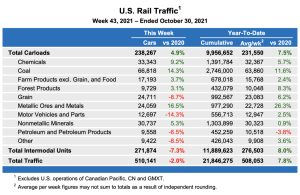

Rail traffic for October and the week ending October 30, 2021

AJOT | November 04, 2021 | Intermodal | Rail | By The Numbers

U.S. railroads originated 947,013 carloads in October 2021, up 3.8 percent, or 34,510 carloads, from October 2020. U.S. railroads also originated 1,077,515 containers and trailers in October 2021, down 7.9 percent, or 92,400 units, from the same month last year.

German factory orders rebound on higher demand from abroad

Bloomberg | November 04, 2021 | International Trade | By The Numbers

German factory orders rebounded in September amid greater demand for investment goods outside the euro area, hinting at a boost to production once supply bottlenecks clear.

E2open’s Ocean Shipping Index reveals 70-day average to ship freight globally

AJOT | November 03, 2021 | Shipping Technology | By The Numbers

New quarterly report helps shippers better understand when to book ocean freight to help ensure goods arrive on time and mitigate risks of downstream disruptions

European road freight rates at record highs

AJOT | November 03, 2021 | Intermodal | Trucking | By The Numbers

The European Road Freight Rate Benchmark for Q3 shows that prices have hit historic highs across Europe, driven by a mix of robust economic growth, global supply chain bottlenecks, rising costs and scarce capacity.

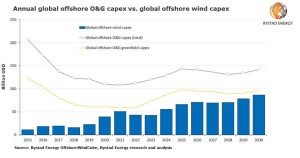

Offshore wind spending is closing the gap against O&G, will exceed it in more regions by 2030

AJOT | November 03, 2021 | Energy | Alternative | Project / Heavy Lift | Maritime Project | By The Numbers

Offshore wind spending is increasingly closing the gap on oil and gas (O&G) investments and is forecast to surpass them in several key markets by 2030, Rystad Energy analysis indicates.

Argentina is first in South America to regain pre-Covid fuel demand

Bloomberg | November 02, 2021 | Energy | Conventional | By The Numbers

Argentina is the first major country in Latin America to see gasoline demand recover to pre-pandemic levels.

Drewry: Ship operating costs moderating but inflationary risks lurk

AJOT | November 02, 2021 | Maritime | By The Numbers

London, UK, 2nd November 2021 – Vessel operating cost inflation has slowed this year as some Covid-19 related expenses unwound and high vessel earnings encouraged some owners to postpone non-essential maintenance work, but wider macroeconomic developments are raising inflationary risks as will decarbonisation initiatives, according to the latest Ship Operating Costs Annual Review and Forecast 2021/22 report published by global shipping consultancy Drewry. Drewry estimates that average daily operating costs across the 47 different ship types and sizes covered in the report rose 0.7% in 2021, which represented a sharp slowdown from the increase of 4.4% recorded in 2020 when opex rose at its fastest pace in over a decade. This compared to increases of 2-2.5% in the two prior years and a net 8% decline in operating costs over 2015-17 (see chart). Drewry ship operating cost index (annual % change) Drewry ship operating cost index (annual % change) Source: Drewry’s Ship Operating Costs Annual Review and Forecast 2021/22 “As some pandemic related costs have unwound and seaborne trade recovered average opex spend has risen moderately in 2021,” said Latifat Igbinosun, head of vessel opex research at Drewry. “Owners have taken advantage of the resumption in trade growth and rising vessel earnings to keep ships in service for longer, depressing some areas of spend.” A high proportion of 2021 opex increases were driven by marine insurance costs which rose 4.3%, slightly higher than 4% recorded during 2020. This was due to a hardening of both hull & machinery (H&M) and protection & indemnity (P&I) premiums during 2020, and this continued into 2021. But spend declined in stores and repair & maintenance (R&M) as some Covid-19 related costs unwound and vessels had limited downtime for maintenance work during the year. The rise in costs was broad-based across all the main cargo carrying sectors for the fourth consecutive year, albeit at a much slower rate compared with last year. The latest assessments include vessels in the container, chemical, dry bulk, oil tanker, product tanker, LNG, LPG, general cargo, reefer, roro and car carrier sectors. Looking ahead, despite buoyant cargo demand across many vessel segments the outlook for freight markets remains highly uncertain and the prevalence of the pandemic continues to disrupt vessel operations. Hence, we expect the pressure on costs to remain which will dampen any likely inflation, but decarbonisation regulations will add to owner cost burdens over the medium term. “Despite the mild outlook inferred by Drewry’s central opex forecast, there still exists some risk of further hardening in the insurance market as well as rising macroeconomic price inflation, both of which could inflate operating costs,” added Igbinosun. “However, we expect wider inflationary pressures to be contained by policy measures.”

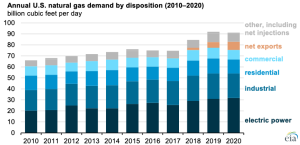

U.S. consumption and production of natural gas decreased while exports grew in 2020

AJOT | November 02, 2021 | Energy | Conventional | By The Numbers

U.S. natural gas production and consumption decreased in 2020 because of mild winter weather and the COVID-19 pandemic's effect on demand, according to our recently released Natural Gas Annual.

BP says oil demand is back above 100 million barrels a day

Bloomberg | November 02, 2021 | Energy | Conventional | By The Numbers

As world leaders discuss the fight against climate change, global oil demand has bounced back above the key level of 100 million barrels a day last seen before the Covid-19 pandemic, according to BP Plc.

Oil in for a bullish week as OPEC+ meeting approaches - Rystad Energy

AJOT | November 01, 2021 | Energy | Conventional | By The Numbers

The oil market is expected to see bullish momentum this week, at least until OPEC+ meets, as traders expect no change of supply policy by the group, despite the extreme market tightness.

Rail Traffic for the Week Ending October 23, 2021

AJOT | October 27, 2021 | Intermodal | Rail | By The Numbers

For this week, total U.S. weekly rail traffic was 510,762 carloads and intermodal units, down 2.3 percent compared with the same week last year.

Rystad Energy’s Weekly Gas and LNG Market Note

AJOT | October 27, 2021 | Energy | Conventional | By The Numbers

Gas markets, which have been rising for weeks, are now entering a more balanced phase as a result of spot market cautiousness and tightening fundamentals.

Oil drops on US crude stocks build projection - Rystad Energy

AJOT | October 27, 2021 | Energy | Conventional | By The Numbers

Rystad Energy’s daily market comment from our Senior Oil Markets Analyst Louise Dickson

Rail Traffic for the Week Ending October 16, 2021

AJOT | October 20, 2021 | Intermodal | Rail | By The Numbers

For this week, total U.S. weekly rail traffic was 496,983 carloads and intermodal units, down 4.2 percent compared with the same week last year.

A record September at Port of Los Angeles as cargo volume exceeds 903,000 TEUs

AJOT | October 20, 2021 | Ports & Terminals | Ports | By The Numbers

Year-to-Date Growth at 26% at America's Busiest Port

Oil declines on expected stocks build in the US and China’s coal policy - Rystad Energy

AJOT | October 20, 2021 | Energy | Conventional | By The Numbers

Oil prices declined today as traders are pricing in an expected build in US crude oil stocks and China’s intent to lower coal prices.

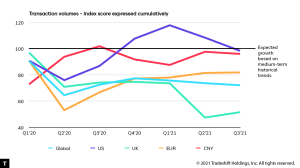

Global order volumes drop sharply in Q3 as supply chain issues put recovery on ice

AJOT | October 20, 2021 | Logistics | By The Numbers

Technology has a vital role to play in relieving pressure across supply chains during volatility cycles

Mobile robot market revenues grow by 20% in 2020 despite pandemic delays

AJOT | October 20, 2021 | Shipping Technology | By The Numbers

Nearly 60,000 mobile robots shipped in 2020 – an increase of over 25% on 2019 with revenues to reach $18 billion by 2025, despite lowered short-term forecast

EIA projects non-OECD Asia to become the largest importers of natural gas by 2050

AJOT | October 20, 2021 | Energy | Conventional | By The Numbers

In our International Energy Outlook 2021 (IEO2021), we project that non-OECD countries in Asia will collectively become the largest importers of natural gas by 2050.

© Copyright 1999–2024 American Journal of Transportation. All Rights Reserved