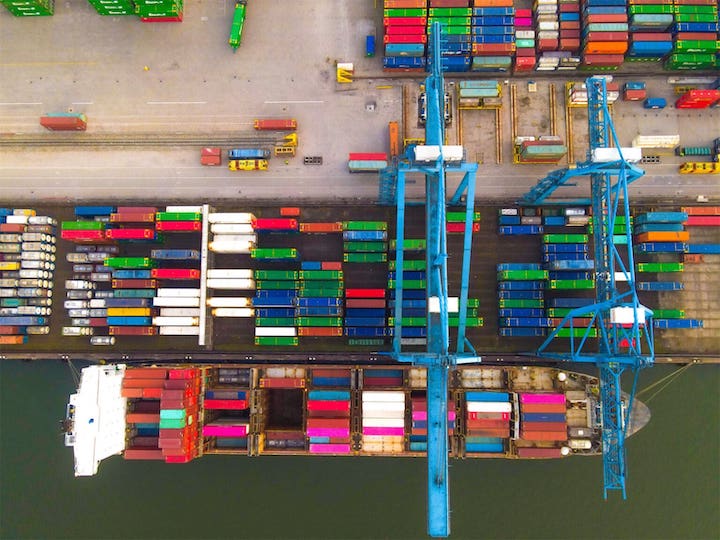

Rotterdam Short Sea Terminals looks to source new cranes from Europe

Rotterdam Shortsea Terminals (RST), which provides feeder ship and inland waterway services from the Port of Rotterdam to European ports and terminals, says it is also looking to source new cranes from Europe, according to Cees van Pelt, Senior Project Manager and former Manager Technical Department at RST.

In an interview with AJOT, van Pelt said there has been an increase of more than 40% in the price of cranes manufactured in China since 2018 and so RST is also looking for quotes from Dutch and other European contractors: “We see a couple of Dutch initiatives who are coming on the market as small, let's say offshore builders or construction companies with a bit of higher technology … and the vision to become a crane builder. I have now asked for a quotation for a stacking crane ... in the yard. If we select a Dutch builder, and we experience that one of them can build a good crane, then I'm quite willing to also build an STS (ship to shore crane) waterside with the wide span crane we use at RST. But first I need to see how they can build the land crane.”

Van Pelt is waiting for quotes from Chinese and European bidders to determine how to proceed.

He emphasized the reason for moving away from only sourcing from China was price and not security related: “It's not because I'm afraid of the China crane… because our electrical installation is all the time … coming from Holland with the Chinese built cranes. The systems integrator TES is working with … overall Siemens components. TES is doing the design, the software … The electrical installation is still … built here in Holland.”

Also, sourcing from the Netherlands or Europe means less travel and closer connections between the terminal executives and the crane builders as opposed to having to fly back and forth to China.

Van Pelt says the real security challenge is from being hacked through computers that requires maintaining high levels of cyber security: “At RST … it's more ongoing process of investments to keep it updated.”

Container Volume Decline

Van Pelt said the loss of the Russia market and complications with the UK market related to Brexit led to a sharp decline in container volumes at RST and the Port of Rotterdam: “RST is bouncing back as container volume is raising again in a competitive market.”

In February, the Port of Rotterdam reported container volume declines in 2023 stating that container throughput in tons was 6.8% lower in 2023 at 130.1 million tons; the fall in TEUs was 7.0% to 13.4 million TEU. Container throughput has proved to be very volatile in recent years in response to COVID and geopolitical developments. The decline that began in 2022 continued in 2023. The main reasons are lower consumption, lower production in Europe and the discontinuation of volumes to and from Russia pursuant to the sanctions. Port calls in the container segment were up slightly by 1.0%. However, container ship cargoes were 7.8% lower. Roll-on/Roll-off traffic (Ro/Ro) fell by 5.0% to 25.9 million tons. The weak British economy and lagging consumption continue to be the main causes. The 5.0% fall in other break bulk is largely attributable to the decline in container rates, which fell sharply in 2023, resulting in more cargo being shipped in containers rather than as break bulk. In addition, disappointing demand in Europe due to inflation and rising interest rates meant that many stocks were left in breakbulk terminals for long periods of time, leaving less room for additional cargo acquisition.

Expansion of Container Terminals by APMT and RWG

However, APM Terminals and Rotterdam World Gateway (RWG) container terminals have announced plans to expand their terminals in the Princess Amaliahaven in 2023. The APMT expansion covers a site of some 47.5 hectares, including a deep-sea quay with a total length of one kilometer. It will add about two million TEUs in terminal capacity. The completion of the quay is planned for the second half of 2024. At RWG, the expansion involves about 45 hectares of terminal land and 920 meters of quay wall, increasing RWG’s capacity by 1.8 million TEUs in phases. Both terminals will be prepared for the use of shore power and will operate in carbon-neutral ways.

Quest for Zero Emissions

RST is also involved at looking to meet zero emission goals by powering cargo-handling equipment such as reach stackers and straddle carriers with hydrogen. The problem is hydrogen is three times more expensive than diesel and while government subsidies are helping to bring the cost of hydrogen down the key is investing in improved delivery infrastructure so as to reduce transportation and handling: “So, we … are building our own facility for making hydrogen and then making it scalable. We hope to support more smaller project(s) to … get it started. But … to get the first … is a bit difficult. But the meeting from yesterday showed that (the) government is now willing, and if there is a grant from the EU (European Union) I have good hope that in the third quarter of 2024 that we can start up with the reach stacker on hydrogen … And as soon as the first one is running, then I expect that soon they will follow more.”

He says Germany is more advanced in hydrogen deployment than the Netherlands because the German government is making a larger investment: “But you see over there that they struggle with the same problems, but the government of Germany is spending a lot more and that makes it much easier to start up.”

Shortage of Younger Workers

Van Pelt says that younger workers are still coming into the maritime industry but at a reduced level: “They are coming in, okay. Not as much as a couple of years ago, but still, young people are coming in less than let's say five to 10 years ago. … But if you look to the more technical people that's a big struggle. You see that there is an old gray layer running to 60 and over and that means retiring …. to replace those guys is quite a challenge … especially in Holland, especially in the western part of Holland … because we have a lot of industry here and a lot of need by every company. So that makes it even harder. And the people, the young people, who are choosing for technology jobs are not quite that much. The schools are nearly empty… for mechanical engineering electrical engineering … but also civil (engineering). You see that it's a struggle, but we need more and more people.”

© Copyright 1999–2024 American Journal of Transportation. All Rights Reserved