In the release of its Commercial Vehicle Dealer Digest, ACT Research reported even before the pandemic plunge in Q2, there was never serious doubt that the demand for commercial vehicles would rise in 2021.

The report, which combines ACT’s proprietary data analysis from a wide variety of industry sources, paints a comprehensive picture of trends impacting transportation and commercial vehicle markets. This monthly report includes a relevant but high-level forecast summary, complete with transportation insights for use by commercial vehicle dealer executives, reviewing top-level considerations such as for-hire indices, freight, heavy and medium duty segments, the total US trailer market, used truck sales information, and a review of the US macro economy.

“While the ‘whether’ of the direction of industry demand in 2021 from 2020 has never been in doubt, the speed of the demand inflection has proven to be a particularly challenging answer,” said Kenny Vieth, ACT’s President and Senior Analyst. He continued, “Demand is sufficiently strong at present that we are turning to historical precedent as a guide for the speed at which the heavy-duty OEMs and suppliers can respond to the demand rally. On top of that, there are two countervailing considerations that we believe could have a direct bearing on the trajectory of the ramp. The first is the challenge of increasing manufacturing employment during a pandemic, with the added protocols and complexity needed to keep workers safe and socially distanced, and the second consideration is the time it takes for the industry to shift to materially higher build rates following the start of robust orders. In most cycles, the lag is typically around six months.”

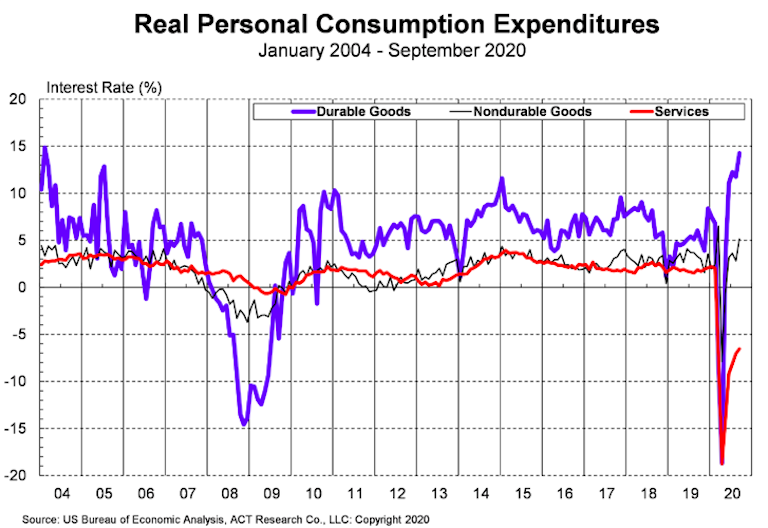

Vieth concluded with comments about the different commercial vehicle segments, “While capacity utilization and productivity are concepts normally reserved for the Class 8 market, medium duty vehicle operations are clearly feeling the impact of the services-to-goods substitution evidenced by consumer expenditures, and with freight rates surging and profitability poised to follow, orders turned sharply higher starting in September for van trailers, Class 8 tractors, and Classes 5-8 vocational trucks. September saw Class 8 orders surge to a two-year high, followed by even stronger orders in October.”

ACT Research is recognized as the leading publisher of commercial vehicle truck, trailer, and bus industry data, market analysis and forecasts for the North America and China markets. ACT’s analytical services are used by all major North American truck and trailer manufacturers and their suppliers, as well as banking and investment companies. ACT Research is a contributor to the Blue Chip Economic Indicators and a member of the Wall Street Journal Economic Forecast Panel. ACT Research executives have received peer recognition, including election to the Board of Directors of the National Association for Business Economics, appointment as Consulting Economist to the National Private Truck Council, and the Lawrence R. Klein Award for Blue Chip Economic Indicators’ Most Accurate Economic Forecast over a four-year period. ACT Research senior staff members have earned accolades including Chicago Federal Reserve Automotive Outlook Symposium Best Overall Forecast, Wall Street Journal Top Economic Outlook, and USA Today Top 10 Economic Forecasters.