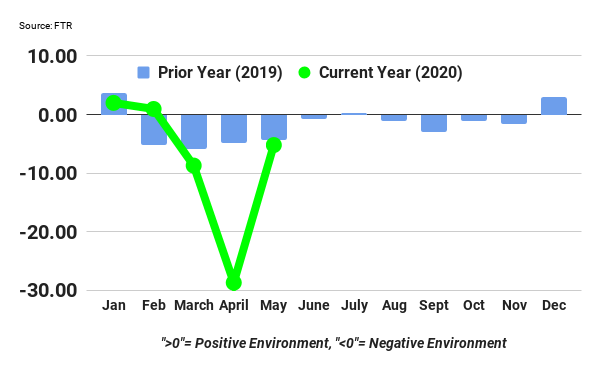

FTR’s Trucking Conditions Index reading for May rebounded from its worst-ever level in April to a reading of -5.19. While much improved, May’s reading is quite negative from a historical perspective. A sharp increase in freight was primarily responsible for the improvement as rates and utilization were still weak.

Consumers led the way as May brought the expected rebound in freight indicators. A less-negative industrial production forecast is the main contributor to a firmer freight outlook for the balance of 2020.

Details of the May TCI are found in the July issue of FTR’s Trucking Update, published June 30th. Additional commentary provides updates on the impacts of the COVID-19 pandemic and expectations for recovery. Beyond the TCI and FTR’s COVID-19 intelligence, the Trucking Update includes data and analysis on load volumes, the capacity environment, rates, costs, and the truck driver situation.

Avery Vise, vice president of trucking, commented, “The spot market is the strongest in two years, which certainly suggests upside to our current outlook. However, the recent increases in COVID-19 cases in some large U.S. states mean that we are not out of the woods yet as some states are moderating their reopening and many universities and school systems remain uncertain about their plans. We are also concerned that the recovery to date is fueled substantially by unprecedented financial assistance from Washington and that further such assistance might be necessary to keep the economy on track.”

The TCI tracks the changes representing five major conditions in the U.S. truck market. These conditions are: freight volumes, freight rates, fleet capacity, fuel price, and financing. The individual metrics are combined into a single index indicating the industry’s overall health. A positive score represents good, optimistic conditions. Conversely, a negative score represents bad, pessimistic conditions. Readings near zero are consistent with a neutral operating environment, and double-digit readings in either direction suggest significant operating changes are likely.