10.6 million SF delivered in 2018 doesn’t offset record 12.8 million SF of absorption

FLORHAM PARK, N.J. – Despite a near-record amount of new development in 2018, New Jersey’s supply of industrial space is not keeping pace with the extraordinary demand, according to Transwestern’s Fourth-Quarter 2018 Industrial Market Report. The 10.6 million square feet of space that was delivered last year – the most since 2001 – was not enough to satisfy the insatiable appetite of tenants, which set a new record for net absorption.

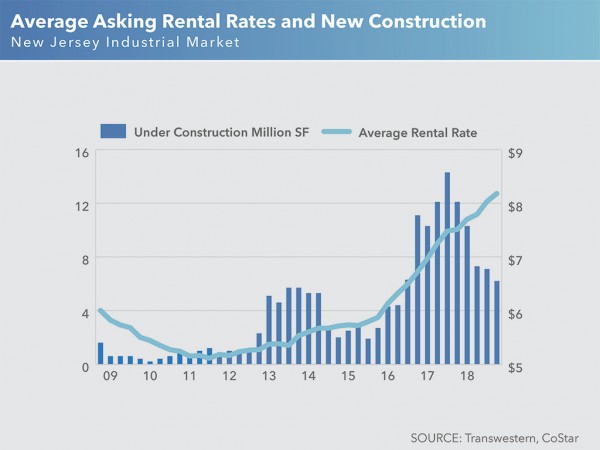

Although 35 million square feet of industrial space has been developed in New Jersey since 2011, occupancy levels have grown by 60 million square feet during the same period. This has resulted in skyrocketing rents, which have increased for 14 consecutive quarters, and have risen to above $9 per square foot in seven submarkets.

“To be competitive in today’s environment, industrial tenants must take advantage of New Jersey’s unparalleled location at the center of the Northeast Corridor,” said Jeffrey Furey, Managing Director at Transwestern. “The demand is so high that tenants are resetting the market when renewing leases, with no choice but to pay significantly higher rents.”

New industrial development is occurring primarily in the central part of the state, along the Turnpike and between Exits 7A and 13A, and, more recently, along the Interstate 287 corridor. An additional 6.2 million square feet is under construction in the state’s core markets, with 5.1 million square feet in central New Jersey alone.

Overall, vacancy across New Jersey reached an all-time low for the sixth consecutive quarter – a trend that’s expected to continue in 2019, despite new construction.

“As the industrial market shows no signs of cooling, New Jersey faces some critical challenges moving forward,” said Matthew Dolly, Director of Research at Transwestern. “While the state boasts excellent air, freight, port, and rail infrastructure, upgrades are necessary. Unless critical needs are addressed, the state’s current infrastructure will have difficulty accommodating the growth that the industrial sector presents.”

_-_28de80_-_d88095865f9f1cbb4ecdd37edf61c63efd603428_lqip.png)