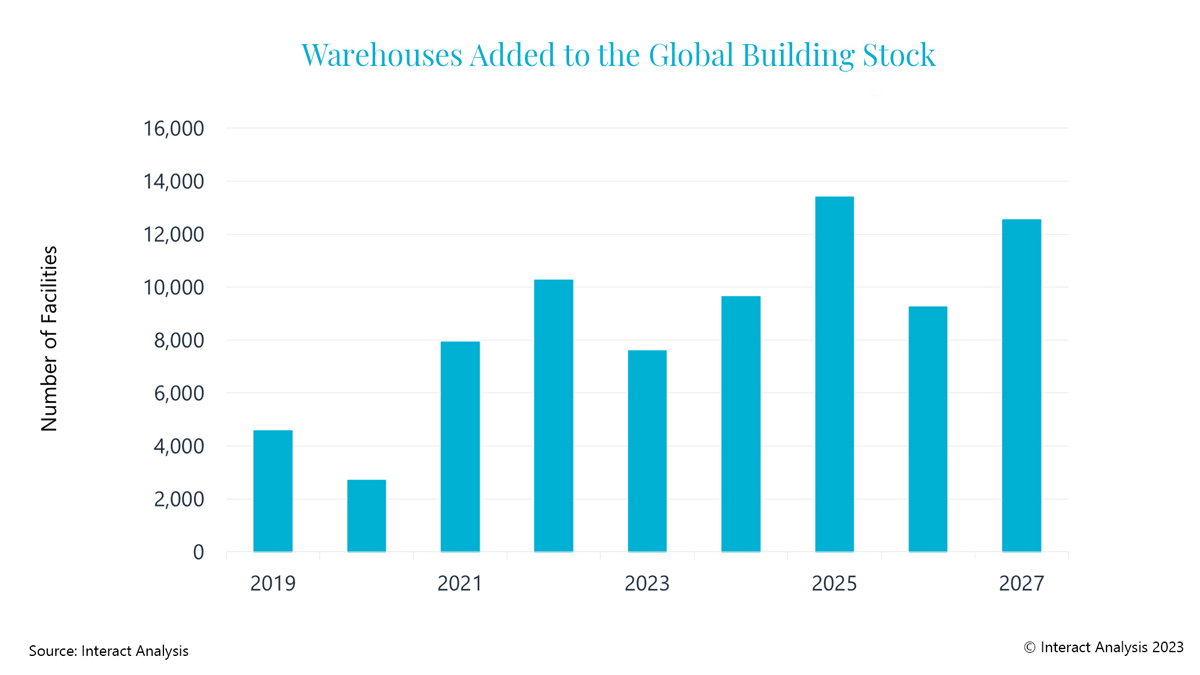

- Renewed E-commerce growth and a shift to just-in-case supply chains will drive an uptick in warehouse construction in 2024

- 25% fewer warehouses will be added to the building stock in 2023 compared to 2022

- Warehouse construction growth will fuel demand for automation solutions in 2024 and 2025

Updated research by Interact Analysis shows that warehouse construction is showing signs of recovering following a slowdown in 2022 and 2023. The slowdown in new warehouse construction was driven by a slowdown in e-commerce growth and higher interest rates, reducing the amount of capital flowing toward real estate developments. However, we’re starting to see e-commerce growth rates stabilize, returning to pre-pandemic levels. Furthermore, the supply chain disruptions caused by COVID-19 are leading to a shift toward just-in-time supply chains, resulting in a need for greater storage capacity.

It is expected that e-commerce growth rates will soon return to double digits, but these are the early signs of recovery and in 2023 Interact Analysis predicts 25% fewer warehouses will be added to the global building stock compared with 2022. Many experts believe e-commerce sales are decreasing compared with the peak of the pandemic, but this is misleading. Interact Analysis delved deeper into the data to find that e-commerce sales haven’t in fact come down despite seeing a declining share of e-commerce sales as a percentage of total retail sales. This is interesting as it suggests that demand for fulfillment capacity is likely to grow at a similar rate to that of pre-pandemic levels.

The shift from just-in-time to just-in-case supply chains will also have an impact on the growth of warehouse construction. Many companies now factor in a greater degree of unpredictability, and this has a knock-on effect on warehouse construction, with companies requiring higher inventory and therefore more storage capacity. This is likely to drive an increase in warehouse construction during 2024 and 2025, and, ultimately, growth in warehouse automation revenues in 2025.

The release of the Warehouse Building Stock Database premium service provides data and which companies own and operate warehouses and which automation vendors they’re working with. Unsurprisingly, Amazon currently has the greatest number of warehouses, followed by Walmart. However, Walmart still has 80% fewer warehouses than Amazon across the UK, France, Germany, Italy, Canada and the US. Despite this, research shows Amazon’s investment in automation per warehouse is significantly lower than many other retailers. For example, if you look at expected warehouse automation investments between 2023 and 2025 and divide this by the number of warehouses each company operates, Amazon scores 14x lower than Adidas, although this is largely due to Amazon’s large warehouse footprint.

Rueben Scriven, Research Manager at Interact Analysis, says, “The uptick in warehouse construction will have a significant knock-on effect on the demand for warehouse automation. Investments are expected to increase towards the end of 2023 and into 2024, with automation revenue growth returning to double digits in 2025. Specifically, we expect the demand for unit storage systems to increase as a result of the shift towards JIC supply chains, particularly in the US.”

_-_28de80_-_d88095865f9f1cbb4ecdd37edf61c63efd603428_lqip.png)