Page 1: Covid-19 and the West Coast Response

Page 2: Market Share and Working on the Railroads

Market Share and Working on the Railroads

West Coast ports – particularly the San Pedro mega-ports of Long Beach and Los Angeles - have for decades been the de facto gateway to the nation’s consumers. And rail connections to the East made it happen for West Coast ports. While the West Coast is still dominant, the widening of the Panama Canal and the terminal and infrastructure expansion on the US East Coast in ports like New York/New Jersey, Savanah, Georgia and Charleston, South Carolina, not to mention the Gulf ports is shifting the narrative.

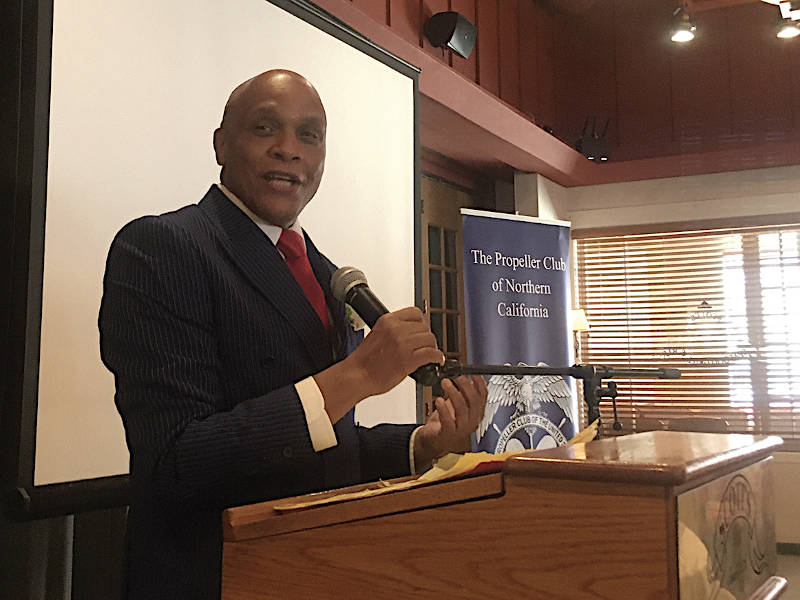

However, the West Coast ports are aware of the dynamic and seek to reverse the trend. In February, Jim McKenna, president of the PMA (Pacific Maritime Association), an industry group largely composed of West Coast waterfront employers and Willie Adams, president of the ILWU (International Longshore and Warehouse Union) at the Propeller Club of Northern California meeting pledged to work together to help West Coast ports regain lost market share. Both leaders agreed that it was vital to lobby the two West Coast rail providers, the Union Pacific (UP) and the Burlington Northern and Santa Fe (BNSF), to reduce the rates they charge for transporting containers to and from the West Coast ports. Willie Adams said the West Coast ports “need to make sure our voices are heard in Washington, DC... our competitors on the East and Gulf Coasts are being heard and it is costing us.”

McKenna agreed that a reduction in rail rates charged by the BNSF and UP could make a major contribution to West Coast competitiveness. Right now, he estimates West Coast costs are $200 per container, higher than East and Gulf Coast ports. Reduced rail rates can close the gap: “The railroads are losing rail business as the West Coast ports lose discretionary cargo and so they know they can contribute to make up the difference and win back some of this cargo.”

For McKenna, another point of contention tied to the rail costs is that Canada does not have a Harbor Maintenance Tax and so the Western Canadian Port of Prince Rupert has a built-in cost advantage in transporting containers by rail to Chicago and other Midwest destinations. The result is the U.S. West Coast ports are also losing business to Prince Rupert.

Still McKenna feels it is more than just what the other ports are doing. He is not alone with the charge of West Coast ports of being complacent about the higher costs of doing business, especially in California, citing: high land costs, high costs of environmental regulations and high charges to reduce truck congestion and institute a clean truck program: “These charges are driving away discretionary cargoes and they’re killing us.”

McKenna agreed that a reduction in rail rates charged by the BNSF and UP could make a major contribution to West Coast competitiveness.

Many of McKenna’s views are shared by others on the West Coast. Gene Seroka, the Port of Los Angeles executive director, also agrees that steps must be taken to regain market share. In an interview with the AJOT, following his “State of the Port 2020” address in Los Angeles in late January, organized by the Pacific Merchant Shipping Association (PMSA), Seroka outlined the new strategy to tackle the trend. Seroka said the Port had to go on the offensive to check the loss of market share: “Well, this market share erosion is now 18 years old, so it’s not a recent phenomenon, right? The markets have shifted. I don’t think we’re going to bring every percentage point back to the West Coast, but we’re going to do three things:

- We’re going to continue to try to promote our supply chain optimization work, which makes this a seamless gateway to use as a gateway of choice.

- We are going to push as hard as we can and double down on digitization (of port)

- And third is collaboration. We want to put together like-minded people. So, West Coast ports, Western railroads, and the MOU (Memorandum of Understanding) we’re signing with the Asia countries.”

As an example, in his State of the Port speech, Seroka said that the Ports of Long Beach and Los Angeles have also signed a Memorandum of Understanding to enhance cooperation between the two ports.

Seroka said he expects the process of regaining the market share initiative to be a gradual one: “...it’s going to be one day at a time, one step at a time to try to earn the business that we need to. We also have to reinvent ourselves because some of that import cargo is not going to come back to us. It’s found other pathways through the Suez Canal.” As an example, he said: “we are going to have to be much more assertive on the export side of the business.” An important focus will be on the service providers, “whether they’re the liner shipping companies, the railroads, the truck firms, they want to execute roundtrip economics. So, I think we need to continue to be aggressive on the export side of cargo that can move through our gateway...”