Nearshoring in Mexico is booming but a Prologis study suggest this is only the beginning.

Prologis, a logistics real estate specialist, in June released a study (see prologis.com “Impacts of Nearshoring on Demand for Mexican Logistics Real Estate) on nearshoring’s influence on the Mexican logistics real estate market.

Nearshoring and variations on the theme like friend-shoring, has become a major topic as international manufacturers look to source both closer to consumers and avoid the trade related issues between the US-China. The built-in solution is the USMCA (US-Mexico-Canada) trade agreement – the successor to NAFTA (North American Free Trade Agreement). [See special section on USMCA on pages 2 - 8].

Although China often gets the print, it is worth remembering that Canada and Mexico are the United States’ largest trade partners, and business is growing — it is this point that is the underlying reason for a logistics real estate boom in Mexico and along the US border.

And as Prologis explains the US business with Mexico is set to expand as a result of the new regulatory environment, “Although U.S.-China back-and-forth tariffs were first applied in 2018, most of them were applied on commodities, such as metals and agricultural products. More recent regulatory decisions—such as restrictions on sales of advanced chips, tax credits for North American-made solar panels/electric vehicles /semiconductors and legislation aimed at improving supply chain transparency, etc.—will continue to pull manufacturing supply chains for high-value goods closer to U.S. consumers.”

Autos Driving Nearshoring

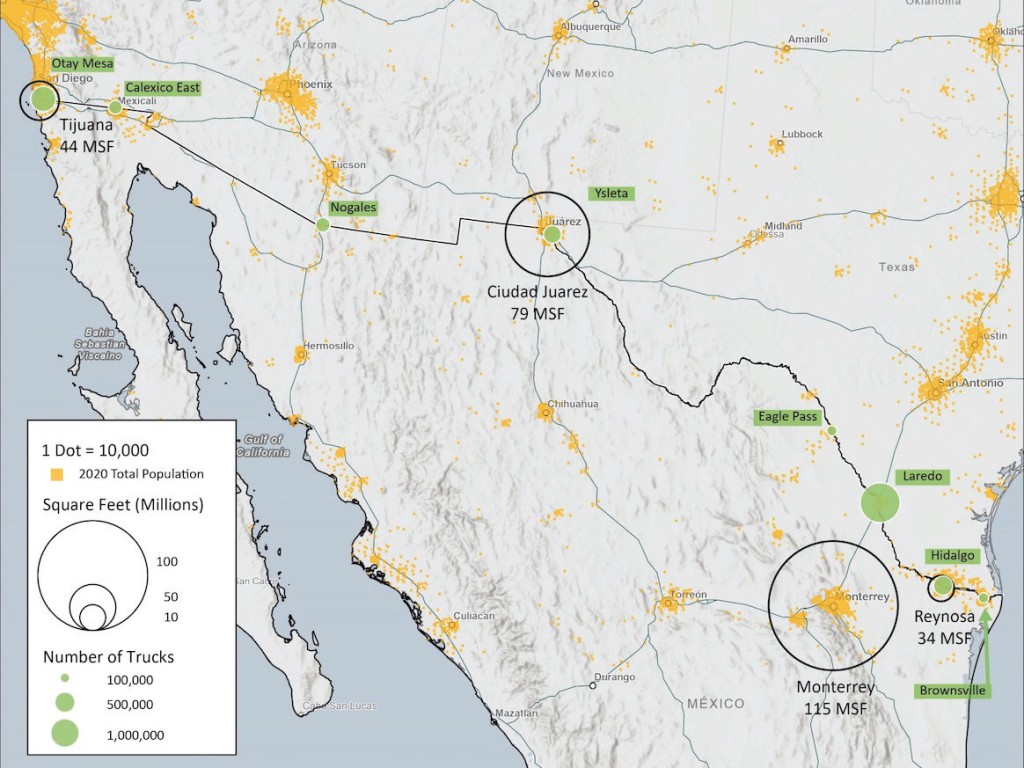

The auto manufacturing is the major business driving nearshoring. According to the Prologis study, every US$1 billion invested in Mexican auto factories can generate 5-10 MSF (million square feet) of local logistics demand. The real estate company explains the logic behind the estimate, “The Bajío region in central Mexico saw a four-time increase in demand for logistics space in 2014-2017, relative to the 2010-2013 period, as several global auto companies established new assembly operations in the region. Based on this, we [Prologis] estimate that every US$1 billion invested in Mexican auto factories can generate 5-10 MSF of local logistics demand during the two years that follow.”

But it isn’t just the auto industry. As more manufacturing nearshores in Mexico, it also attracts supporting services. According to the Prologis report “Tier 1 nearshoring annual absorption (direct manufacturing capacity expansions to supply the U.S., installed in leased logistics space) grew from 3 MSF in 2019 to 16 MSF in 2022, increasing from 8% to 26% of gross absorption in the country. Tier 2 nearshoring absorption (domestic suppliers and third-party logistics providers that specialize in manufacturing warehousing) grew from 15 MSF in 2019 to 29 MSF in 2022, or nearly half of gross absorption.”

The Beginning of a Trend?

The Prologis study suggests that the logistics property boom south of the border, this is only the beginning of a much larger expansion. The report cites the building of new projects like Tesla’s proposed plant which was announced last February and other “high-value sectors —such as electronics, appliances and green technologies—have announced expansions in Mexico.”

To sum up the prospects, Prologis says “Given Mexico’s advantages of location, free trade, and labor, we expect further investments to continue to drive logistics real estate demand because it takes time for supply chains to pivot in response to changing cost and regulatory frameworks…”

_-_28de80_-_d88095865f9f1cbb4ecdd37edf61c63efd603428_lqip.png)