Temperature-controlled cargoes will likely play a big role in the lane.

The Canadian Pacific Railway’s $31 billion purchase of the Kansas City Southern, a deal approved by U.S. rail regulators in March, resulting in the new CPKC, created a rail carrier that connects all three nations of the United States Mexico Canada Agreement (USMCA). The Kansas City Southern (KCS) had strength carrying freight in and out of Mexico, but other North American Class I railroads aren’t sitting back and letting CPKC dominate the trade on that lane.

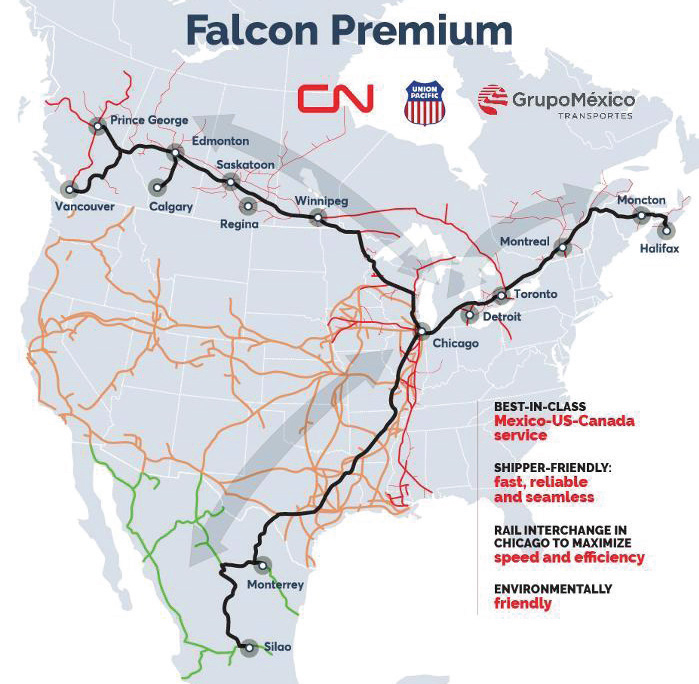

On the contrary, the Union Pacific (UP) and the Canadian National (CN) have teamed up, along with the Mexican operator Grupo Mexico Transportes (GMXT), to offer intermodal services between the U.S. and Mexico.

Intermodal Competition

Intermodal will likely be where the competition among the railways will be most heated for U.S.-Mexico business, for a number of reasons. One is that intermodal traffic between the U.S. and Mexico represents a very small fraction of total trade, indicating that there is room to grow. Another is that using intermodal rail avoids highway congestion at the border and promotes companies’ sustainability goals. The rising nearshoring trend has sparked moves by manufacturers to set up production facilities in Mexico to serve the USMCA market, which also stands to boost intermodal cargo flows in and out of Mexico. The Federal Reserve Bank of Dallas recently reported that Mexico was the U.S.’s biggest trade partner so far this year.

One week after the CPKC combination was approved by regulatory authorities, the carrier announced a partnership with Schneider National, which has been operating in Mexico for over three decades, to provide intermodal services between Chicago and Mexico. CPKC later announced another intermodal pact with Knight-Swift Transportation, a multi-year agreement, also for a Mexico-to-Chicago train. Knight-Swift has an established Mexico customer base through its TransMex subsidiary that employs 1,500 unionized drivers south of the border.

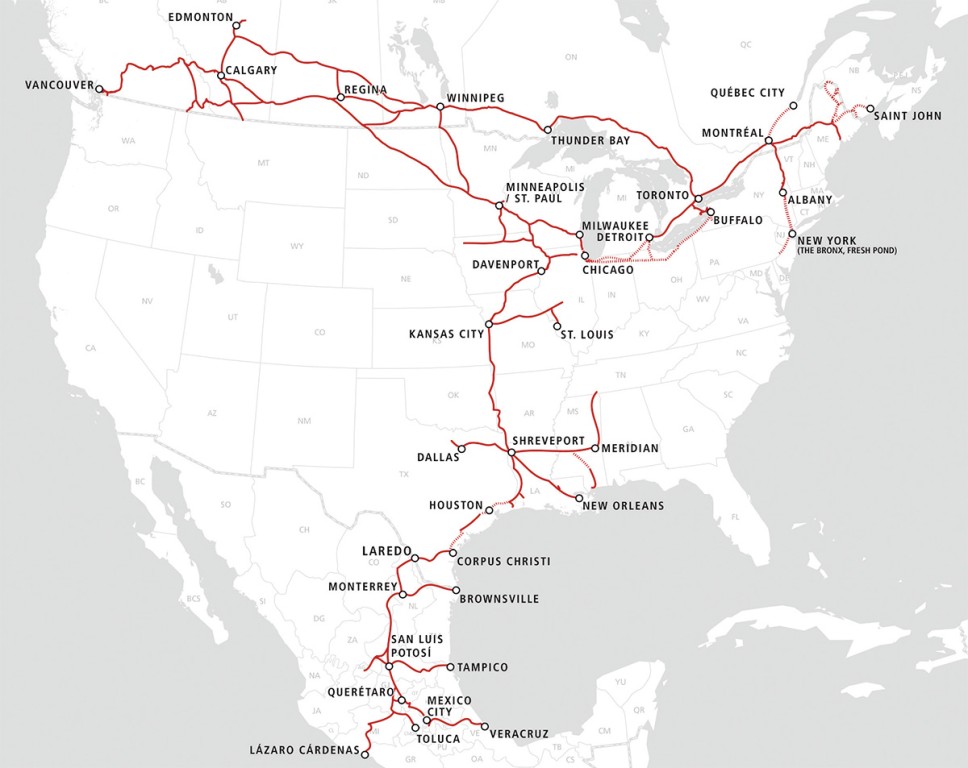

CPKC’s MMX service, which debuted May 11, links Chicago, Kansas City, Texas, Monterrey, and San Luis Potosi. The trains offer third-day service to and from Laredo, fourth day to and from Monterrey, and four and half days to and from San Luis Potosi. Transit time from Chicago to San Luis Potosi totals 98 hours.

Soon after the CPKC-Schneider alliance came about, the UP announced the creation of a new intermodal service spanning the nations of the USMCA. Together with CN and GMXT, it announced the Falcon Premium service to connect CN points in Canada and Detroit with GMXT’s terminals in Monterrey, Nuevo Leon, and Silao in Mexico. Falcon Premium will transit UP’s Texas-to-Chicago route and CN service connecting Chicago to Canada.

Intermodal Has Room to Grow

The ratio of U.S.-Mexico trade handled by intermodal rail has been reported as well under 10%, suggesting that there is a lot of room for growth. “When you look at similar length of haul, you would expect much higher conversion to intermodal,” said James Filter, group president for transportation and logistics at Schneider National. “So, we see that as an opportunity for growth.”

The CPKC-Schneider combination will improve intermodal possibilities in the U.S.-Mexico trade, according to Filter by bypassing “the number of interchanges that you would experience moving freight from Mexico into the U.S. Each one of those interchanges is a potential point of failure.” CPKC’s single rail delivery will transit from Schneider’s three ramps in Mexico “directly up to the Midwest,” said Filter, improving service levels over the former KCS, “an area that struggled with service.” According to the Intermodal Association of North America, 70% of containers moving from Mexico terminate in the U.S. Midwest.

The UP-CN Falcon Express service is expected to be carrying automotive parts, home appliances, and temperature-controlled products. CPKC is betting that its MMX service will be carrying large volumes of temperature-controlled cargoes, as evidenced by its announcement in May that it was more than doubling its existing fleet 53-foot, refrigerated intermodal containers by adding 1,000 new ones to its inventory. CPKC expects the MMX temperature-controlled service will be moving fresh and frozen produce, baked goods, candy, and other food products northbound, and beef, chicken, and pork southward.

“Hundreds of trucks cross the border at Laredo, Texas, every day carrying refrigerated and frozen cargo,” said Keith Creel, CPKC’s CEO. “Trucks can spend two to three days at the border while their cargo is unloaded, inspected, and reloaded.”

CPKC’s International Railroad Bridge over the Rio Grande River at the U.S.-Mexico border at Laredo, Texas, offers an alternative to highway ports of entry, he noted. A second span to expand the bridge’s capacity and further increase the efficiency of cross-border train movements is currently under construction and expected to be completed by the end of 2024.

CPKC is also “on the verge of creating inland terminals with support of the Mexican regulator,” Creel added, “to allow beef and poultry to be inspected inland and not at the border.”

Temperature-Controlled Market

In June, CPKC and Americold Realty Trust announced a collaboration to co-locate Americold warehouse facilities on the CPKC network. The intent is to build the first facility in Kansas City, bringing together cold storage, value-added-services, and expedited intermodal transportation connecting the U.S. Midwest and Mexico.

Transit time will likely emerge as a key factor in the competition for intermodal business between the U.S.-Mexico border and Chicago. The UP-CN route is shorter than CPKC’s and offers four-day transit times.

Tracy Robinson, president and CEO of Canadian National, said that the new service “creates the most direct route and the fastest transit times between Canada and Mexico. It will provide our intermodal customers with the efficiency of bigger payloads and the ability to accelerate the shift of truck business to rail.”

Falcon Premium, she added, “leverages each partner’s best services and routes to create a transformational new product.”

Creel acknowledged that the CPKC route is 194 miles longer than that of its competitor but asserted that CPKC will be able to deliver goods from Chicago to Monterrey, nearly two days faster than Falcon Premium. CPKC will also operate a shorter and faster route into the Mexico City area, he said.

“A shorter route does not necessarily mean faster service,” said Creel. “We’re ready to compete.”