Can the supply chain change fast enough to halt climate change?

COP 28 and Decarbonization of the Global Supply Chain

On November 20th the United Nations Environment Program (UNEP) released its Emissions Gap Report (EGR) 2023 — the 14th, which was published ahead of the 28th session of the Conference of the Parties to the United Nations Framework Convention Climate Change, better known as COP 28, which was held in Dubai, UAE November 30 through December 12th.

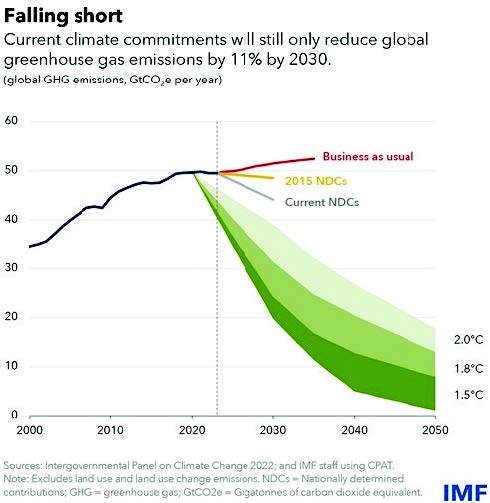

As expected, the results of the ERG report weren’t good. The ERG opening paragraph laid out the unhealthy situation, “The world is witnessing a disturbing acceleration in the number, speed, and scale of broken climate records. At the time of writing, 86 days have been recorded with temperatures exceeding 1.5°C above pre-industrial levels this year. Not only was September the hottest month ever, [but] it also exceeded the previous record by an unprecedented 0.5°C, with global average temperatures at 1.8°C above pre-industrial levels.” The rest of the report wasn’t any sunnier, outlining GHG emissions must fall by 42% by 2030 to hold global warming at the critical 1.5 degrees C (2.7 degrees F) mark.

Perhaps the biggest achievement at COP 28 was an agreement that, while it does not specifically outline “phasing out fossil fuels”, opens a path to the deployment of low-carbon energy systems and an emphasis on renewables — a path which operating segments of the supply chain have already embarked.

COP 28: And All the Ships at Sea…

There are now around 118,928 merchant ships plying the world’s waters of nearly 1,479,783 gross tons and to a large degree, even with the many technological refinements and massive increases in size, much the same as their predecessor merchant ships – propulsion powered by fossil fuels.

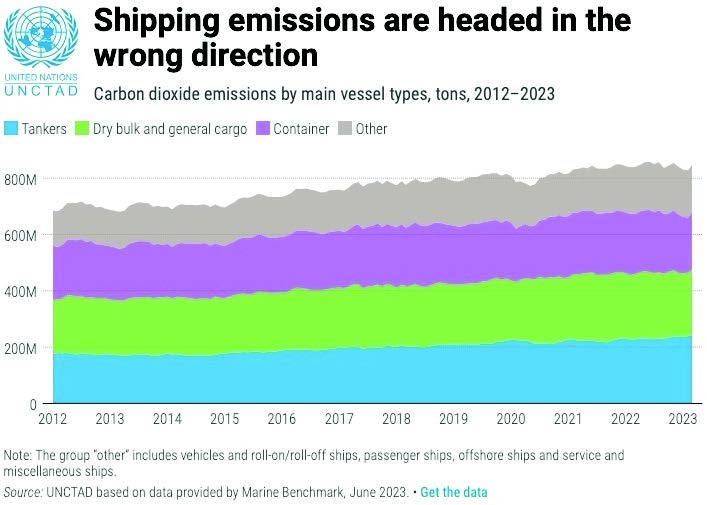

Rebeca Grynspan, Secretary-General of UNCTAD addressing a COP 28 side event titled, “The 2023 IMO GHG Strategy: Defining the global level-playing field for shipping decarbonization” laid out the situation, saying, “Our maritime transport system is the lifeblood of the global economy, facilitating over 80% of the world’s trade volume. Yet, this vital sector also contributes to nearly 3% of global greenhouse gas emissions. As sea-borne trade has grown, emissions have escalated by 20% in just the past decade, a trajectory we simply cannot afford to continue… Our message today, here at the COP, is very clear: bold, global action is necessary to decarbonize shipping.”

On December 7th, the World Shipping Council (WSC), an organization representing the largest liner shipping operators, released a statement in relation to the COP 28 meeting outlining the goals and challenges facing containership carriers. WSC President and CEO John Butler said, “Liner carriers are committed to delivering on the 2050 net zero target and are already investing in renewably propelled ships. To ensure there are renewable fuels available to run those ships, in a competitive manner, energy providers must see regulations written in the next two years that demonstrate sufficient demand for new fuels to justify the massive investments need in the immediate future. The challenge for member states at IMO is not just to agree, but to agree on regulations that will provide investment certainty. If we can get this right from the beginning, we will speed the energy transition and make it more affordable by avoiding stranded investments.”

Butler’s remarks demonstrate that there is a willingness for containership carriers to address decarbonization but that it is far from a clear path to a net zero future. There are expensive technological choices to be made in building a new generation of containerships.

A study published by UMAS, a United Kingdom-based consultancy group, wrote that ocean freight rates would need to be up to $450 per TEU to cover the cost of low-carbon fuels. Given the fact that ocean carriers have often added bunker surcharges to freight charges it is likely these rates would be passed on to the shippers.

What will they be powered by? Some believe ammonia is the best “alternative” fuel in the near term future. How much assistance can wind power provide — is it feasible? Is hydrogen really the ultimate solution or is nuclear power going to make a comeback? Where does carbon capture figure into ship decarbonization? What is the electric future for ship propulsion?

And it is also worth noting, that while container ships are the most visible aspect of shipping, the container ship — liner shipping — represents only 4.6% of the merchant fleet and decarbonization is a goal for all the ships at sea.

Tracks for Decarbonizing Rail

Although the process for decarbonizing trucking is well documented, less has been written about decarbonizing railroads. Railroads by the sheer tonnage of their hauls are inherently more energy-efficient and “sustainable” than “internal combustion engine” (ICE) trucking. But the lack of electrified rail and the vast distances moved makes decarbonizing rail in the US, a complex problem moving to net zero. In contrast, Europe has much more electrified rail and a more comprehensive approach to rail decarbonization. (see Stuart Todd’s AJOT article “New financing platform aims to green European rail freight” on page 10).

In August, AJOT’s Senior Business correspondent Matt Miller wrote, “Railroads rightly tout the fact that they’re the most energy-efficient way to move freight, a quarter to a third (depending on the study) of the carbon produced per ton of freight by trucks. However, that doesn’t mean rail, especially in North America, is shaded dark green.” (See AJOT August 21 edition 756, page 2, Is there a track to net zero for US railroads.)

At COP 28, US Secretary of Energy Jennifer M. Granholm, US Secretary of Transportation Pete Buttigieg, and Canada’s Minister of Transport Pablo Rodriguez issued an interesting statement on decarbonizing rail in North America. The statement, in part said, “Recognizing the important role transportation plays in reducing greenhouse gas emissions, the United States and Canada have created a “Rail Decarbonization Task Force” to develop a common vision to reduce emissions from the rail sector.” The statement went on to outline the group’s objectives stating:

- “establish a joint research agenda to test the safe integration of emerging technologies, including hydrogen-powered and battery-electric locomotives.

- coordinate strategies to accelerate the rail sector’s safe transition from diesel-powered locomotives to zero-emission technologies to ensure a net-zero rail sector by no later than 2050; and

- collaborate on the development of a U.S.-Canada rail sector net-zero climate model by 2025.”

A noble agenda, but the Task Force has its work cut out for them. North American rail is the least electrified large network in the world. At present, approximately 1% of rail is electrified, and that’s limited to passenger trains like the AMTRAK system. All freight trains remain powered by diesel locomotives. And as Miller wrote, the challenge to electrify the rail network is immense, “To put it another way, the US boasts a rail network of about 140,000 miles. Electrifying that network would cost an estimated $7 million per track mile or a stunning $980 billion.”

Nonetheless rail is a critical piece of infrastructure that has to get on track to meet the decarbonization goals outlined by the Task Force at COP 28 and the Paris Agreement.

Test Flight: The Air Transport Decarbonization

As difficult as it will be to decarbonize rail, the real challenge to decarbonizing the supply chain will be in air transport. There are few easily applicable solutions. Back in October of 2022, a World Bank blog entitled “Decarbonizing air transport: Sustainable aviation fuels are vital for growth” outlined the challenges. As the title for the blog implies, at the heart of the challenge is the need to find new aviation fuels – jet fuel is mostly a blend of around 30% kerosene and 70% gasoline – neither environmentally friendly. According to a 2022 World Bank study entitled “The Role of Sustainable Aviation Fuels in Decarbonizing Air Transport,” Direct emissions from jet fuel combustion in domestic and international aviation already account for 12% of CO2 emissions from the transport sector and as much as 2.5% of global CO2 emissions. So, the obvious answer is finding a new environmentally friendly fuel, one that is likely a low-carbon solution. The blog, which featured a conversation between two World Bank experts, Megersa Abera Abate, a Transport Economist, and Charles E. Schlumberger, a Lead Air Transport Specialist, addressed the issue of finding alternative fuels. When asked how to make air transport greener Schlumberger outlined what is currently in play saying, “The big focus is on decarbonizing air transport to get to net zero emissions by the year 2050... It is notable that aviation is the first industry in the world that has a global commitment and a global program to decarbonize through the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA). It is a trading scheme for offsetting aviation emissions... But to reach net zero, we need more than an emissions trading scheme. We are also going to need Sustainable Aviation Fuels, or SAF. These are biofuels, made from different feedstocks such as crops, municipal waste, or others. Many SAF are already certified for use in existing airplanes, blended up to 50% with conventional jet fuel.”

Schlumberger added that the decarbonizing through better efficiencies in operations and innovations in aircraft design and propulsion technology combined with SAF could reduce emissions by up to 85% by 2050. But as with other transportation sectors, whether air transport can meet these goals in the timeframe outline by the Paris Agreement and COP 28 is a question mark.