Energy

Energy industry news - solar, wind, hydroelectric, natural gas, petroleum.

EIA expects US energy-related carbon dioxide emissions to fall 11% in 2020

| December 09, 2020 | Energy

In 2020, carbon dioxide (CO2) emissions from the U.S. energy sector could be 11% lower than in 2019, according to U.S. Energy Information Administration (EIA) data through August and EIA estimates for September through December. According to values published in EIA’s December Short-Term Energy Outlook (STEO), EIA expects CO2 emissions in 2020 to fall by 19% for coal, by 13% for petroleum, and by 2% for natural gas. Many of this year’s changes in energy-related CO2 emissions are attributable to the economic and behavioral effects the COVID-19 pandemic has had on energy consumption.

Oil stalls with market awaiting stimulus, vaccine developments

| December 08, 2020 | Energy

Oil edges lower with virus risks hampering demand outlook

| December 08, 2020 | Energy

Kinder Morgan announces 2021 financial expectations

| December 08, 2020 | Energy

Asia’s historic trade pact to open oil-supply route to China

| December 08, 2020 | Energy | International Trade

South Korea and Japan look set to be the biggest winners in the Asian oil and chemicals marketplace as the world’s largest regional free-trade agreement paves the way for a gradual reduction in tariffs.

Offshore helicopter traffic plunged by 15% due to the pandemic

| December 07, 2020 | Energy

Global demand for helicopter transport to offshore facilities plunged in 2020 as a result of the Covid-19 pandemic, a Rystad Energy report shows. Helicopter traffic was affected as non-critical maintenance crews were moved to shore and other non-essential operations at offshore facilities were preventatively deferred to reduce the risk of contamination and conserve cash.

Oil analysts see battle for Asian market ahead of peak demand

| December 07, 2020 | Energy

Biggest Iranian flotilla yet en route to Venezuela with fuel

| December 06, 2020 | Energy

North Sea crude market gets a jolt from Asian oil demand

| December 06, 2020 | Energy | Logistics

Iraq to honor OPEC oil-cut decisions as monthly exports rise

| December 06, 2020 | Energy

Rystad Energy’s daily market comment from our Head of Oil Markets Bjornar Tonhaugen

| December 04, 2020 | Energy | Conventional | By The Numbers

Oilfield service purchases set to lose $340 billion until 2028 as peak oil is closer than ever

| December 03, 2020 | Energy

The oilfield service (OFS) market is projected to lose a cumulative $340 billion in purchases value over the next eight years, a Rystad Energy analysis shows, as peak oil demand will arrive earlier and at a lower level than previously thought, leading to reduced E&P investments.

Logisticus Group partners with Georgia tech team for the afterlife of wind turbine blades

| December 03, 2020 | Energy | Alternative

Rockies become diesel bright spot between West and East coasts

| December 03, 2020 | Energy | Intermodal

US imports of Saudi crude oil fall to lowest in three decades

| December 02, 2020 | Energy | International Trade

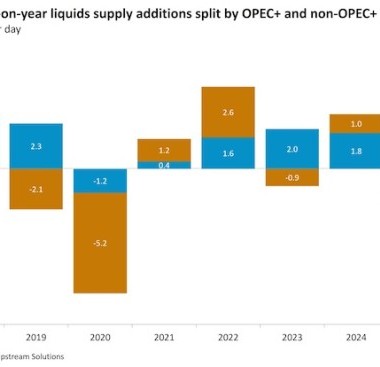

OPEC core’s oil exports drop before face-off over output targets

| December 02, 2020 | Energy | International Trade

Oil-hungry Asia lures armada of tankers carrying US crude

| December 01, 2020 | Energy

Oil extends drop after industry report shows US supply build

| December 01, 2020 | Energy

Dirty fuel demand jumps with more pollution kits on ships

Venezuela oil exports almost triple even as US adds sanctions

| December 01, 2020 | Energy

© Copyright 1999–2024 American Journal of Transportation. All Rights Reserved