Energy

Energy industry news - solar, wind, hydroelectric, natural gas, petroleum.

Here’s the latest on Libya as it restarts oil output and exports

| September 28, 2020 | Energy | Conventional

Oil market in a muddle from mixed messages on demand, glut

| September 27, 2020 | Energy | Conventional

Saudi Arabia sends blue ammonia to Japan in world-first shipment

| September 27, 2020 | Energy | Alternative

Climate Policies And Energy Firms Face A Pivotal Moment In The Energy Transition, Reports Say

| September 25, 2020 | Energy

In 2019, 9 of the 10 highest-generating U.S. power plants were nuclear plants

| September 25, 2020 | Energy | Alternative

According to U.S. Energy Information Administration (EIA) data on power plant operations, 9 of the 10 U.S. power plants that generated the most electricity in 2019 were nuclear plants.

Total to replace oil refinery with clean fuel and plastic plants

| September 24, 2020 | Energy

Shrinking stockpiles boost oil with gains capped by Fed warning

| September 23, 2020 | Energy

Libya to restart oil exports at a third port as war abates

| September 23, 2020 | Energy

Venezuela and Iran buck U.S. sanctions again to export crude

| September 22, 2020 | Energy | Conventional

Rystad: Energy transition could push oil majors to sell or swap oil and gas assets of more than $100 billion

| September 22, 2020 | Energy | Conventional | By The Numbers

The global energy market is on the brink of a major transition to cleaner sources of energy. To adjust and transform, the world’s largest oil and gas firms are revising their long-term oil price and demand outlook, and need to streamline their portfolios significantly to improve cash flow, cost efficiency and competitiveness. As a result, several billions of dollars in assets are about to change hands.

Rystad Energy’s daily market comment from our Head of Oil Markets Bjornar Tonhaugen

| September 22, 2020 | Energy | Conventional | By The Numbers

Global oil & gas project sanctioning is set to recover and exceed pre-Covid-19 levels from 2022

| September 21, 2020 | Energy | Conventional | By The Numbers

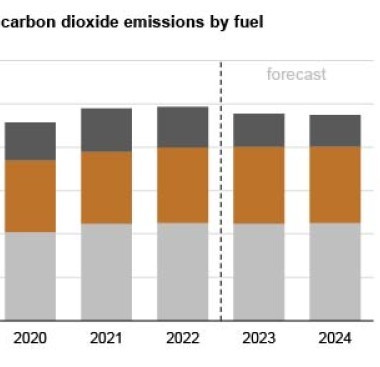

The Covid-19 pandemic has devastated global oil and gas project sanctioning this year and will cause total committed spending to drop to around $53 billion from 2019’s $190 billion, Rystad Energy projects. Postponed plans will, however, cause the total worth of final investment decisions (FIDs) to double next year and exceed pre-pandemic levels already from 2022.

Rystad Energy’s daily market comment from our Head of Oil Markets Bjornar Tonhaugen

| September 21, 2020 | Energy | Conventional | By The Numbers

Oil set for weekly gain despite potential for libyan exports

| September 18, 2020 | Energy | Conventional

Rystad Energy’s daily market comment from our Head of Oil Markets Bjornar Tonhaugen

| September 18, 2020 | Energy | Conventional | By The Numbers

Why costlier 14 MW turbines actually reduce the large-scale farm bill

| September 18, 2020 | Energy | Alternative

Siemens Gamesa’s massive 14-megawatt (MW) wind turbine is set to become commercially available from the mid-2020s, furthering the industry’s push for larger and more efficient facilities.

China mulls stronger clean energy goals for next five years

| September 17, 2020 | Energy | Alternative | International Trade

Pemex sees plunge in oil exports to supply AMLO’s refinery

| September 17, 2020 | Energy | Conventional

EIA survey of energy use by US manufacturers shows increased use of natural gas, HGLs

| September 17, 2020 | Energy

Preliminary results from the U.S. Energy Information Administration’s (EIA) 2018 Manufacturing Energy Consumption Survey (MECS) show that the consumption of energy by manufacturers in the United States has continued to increase since its 2010 low. Natural gas and hydrocarbon gas liquids (HGLs) led the increase, together accounting for more than half of the sector’s energy consumption in 2018. The U.S. manufacturing sector’s consumption of electricity has also increased slightly since 2010, but consumption of naphtha and fuel oils, coal, coke, and breeze has declined.

© Copyright 1999–2024 American Journal of Transportation. All Rights Reserved